The US Congress and the White House have been pushing hard for “decoupling” from China. And a part of that objective is moving manufacturing out of China — and ideally to reshore to the USA.

It may be too early to draw a conclusion on the effect of their decisions (the tariffs but, more generally, the perceived risk of stronger and stronger measures). But here is a short summary of what I have seen, heard, and read.

Large companies have been diversifying their footprint

This is particularly obvious in electronics. Apple, Microsoft, and other large companies that rely on (mostly) Taiwanese contract manufacturers have been requesting a move of some assembly operations to Vietnam, Malaysia, and other places. This has left a big void in some Chinese manufacturing facilities.

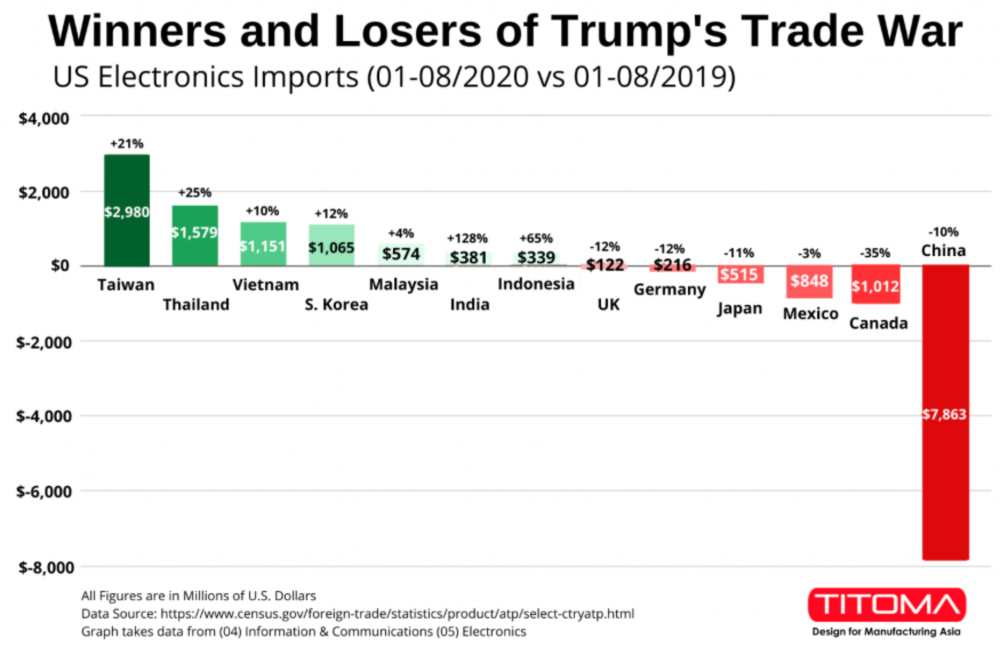

Our friends at Titoma have collected data and put together this graph, which shows where electronic assembly operations have moved:

A drop of 10% in 1 year is not insignificant…

Once the assembly has moved, the hard work of getting component sources from outside China has started, and this will necessarily take much longer.

In contrast:

- Smaller companies have had a much harder time relocating their manufacturing.

- Companies that have invested in their own manufacturing facilities in China tend not to move.

The reality is different depending on the type of product

Making garments and home textiles outside of China is not challenging. Except maybe for complex garments (e.g. jackets, bras) to be made in very large quantity with very short lead times.

In contrast, finding a new source is very difficult for many hard goods. Take power tools, lighters, or microwave ovens, for example. China has a far wider range of products on offer and the value for money is often the best.

Companies that don’t develop their own products have fewer options

If you are looking for a toaster that has already been developed, it will be hard to skip China. Suppliers there have showrooms full of various designs of toasters. You don’t have to pay for the molds, you don’t have look for the suppliers of components… you pick a turnkey product, they put your brand on it, and you sell it.

In contrast, if you develop your own toaster from scratch, you can decide whether or not to use Chinese components, and you have many options for the assembly & testing facility — for example in Vietnam, Poland, or Mexico.

Companies that make in China for China + Asia have fewer reasons to relocate

A lot of items are made in China AND in North America AND in Europe.

For instance, Siemens makes fMRI machines (for hospitals) in China to be closer to all East Asian customers, and this is not going to change. These are highly-engineered and customized 20 million RMB pieces of machinery.

Now, could Siemens make fMRIs in the USA, rather than serving North America from China (for the West Coast) and Germany (for the East Coast), if it means much lower risks? They might. But it is probably not a strategic imperative in the short term.

Contrast that with face masks and hazmat suits. Earlier this year, the world discovered that virtually no other country makes enough PPE to cover its own population’s needs.

If you need a large supply of PPE today, you will probably have to buy it from China. And prices of PPE have come down a lot since April, so I am not sure many investors are willing to invest in relocating that kind of manufacturing activity.

Brands that are worried about a backlash against China are more likely to move out

I haven’t read any clear stories about brands that recently pushed hard to make their products outside of China for ethical or image reasons.

(Naturally, if they also sell a lot in China, they will not say a word about those efforts, for fear of alienating a part of their customers.)

As Dan Harris wrote last year, the question is Will Your Business in/with China Hurt Your Business Reputation Outside China? More and more countries’ public opinion see Beijing negatively. If this trend continues, there might be a real backlash.

**********

Have I forgotten an important factor about moving manufacturing out of China? Please share it in the comments. Thanks!

Let’s say you’re interested in moving manufacturing out of China to using suppliers in SE Asia, perhaps in Vietnam?

Quality Assurance is still a key issue, so you’ll like this free eBook:

Read: ‘Quality Assurance In China Or Vietnam For Beginners‘

Download your free copy of Sofeast’s eBook and learn the common traps new importers from China or Vietnam fall into, and how to avoid or overcome them in order to get the best possible production results. It also outlines a proven quality assurance strategy that you can follow in order to have better control over your product quality, covering:

- Finding Suitable Suppliers

- Defining your Requirements before Production Starts

- Don’t Skip the New Product Introduction Process

- Regular Quality Inspections (Trust but Verify)

- Tying Payments to Quality Approvals

Sounds good? Hit the button below to get your copy now: