The French Chamber of Commerce in China just released the videos of most of the excellent presentations given in their big sourcing event, Made in Asia.

I just watched the presentation by Ben Simpfendorfer from Silk Road Associates, a strategic consultancy. Watch his presentation on Youtube below, and his presentation slides are here.

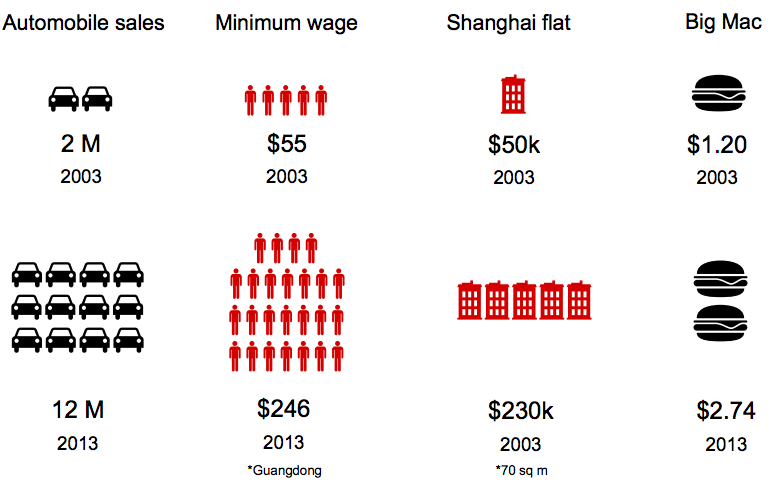

Here is one graph that got my attention:

The rest of Ben’s presentation revolves around these topics:

- The implications for China’s market share (vs. other manufacturing countries)

- The blurring distinction between “high cost” and “low cost” countries

- Asia’s demographic trends, and their impact for the sourcing industry

- The rise of “near-sourcing” (Eastern Europe & Turkey for Europe, Latin America for the US & Canada)

- The very strong rise of Asia as a consumer market (equivalent to Western Europe and the US, combined)

- Where China imports its consumer goods from

- Perspectives on Africa as a manufacturing center

- The differences between coastal China and other provinces

Ultimate Guide To Sourcing From China And Developing Your Suppliers [eBook]

This FREE eBook starts from the beginning, discussing whether you need to hire a sourcing agent, and follows the sourcing process right through to developing a trusted supplier’s quality and productivity.

There are 15 chapters over 80+ pages to explore, providing exhaustive guidance on the entire sourcing and supplier development process from start to finish, including:

- Identifying suppliers,

- Negotiations,

- Quality inspections,

- Developing Chinese suppliers,

- Improving factory quality and productivity,

- and much more…

I also believe in the “nearsourcing” initiative ie Latin America/Mexico for USA but I believe there is still a big problem that is yet to be solved. All the materials and parts still have to be shipped into Mexico which becomes expensive and doesnt negate the benefit of a shorter lead time. Second, mexican workers productivity is lower than China while wage is still higher. In addition, there is a “supermarket” scenario if you will, in China where we can pick up whatever we need from local shops ie tooling, die, machinery, base materials, packaging, etc. The supply chain is still all in China.

Thanks for sharing your observations. I totally agree. Not to mention, the Mexican factories along the US border share a lot of of the same challenges as China (migrant workforce that all goes back home once a year, high turnover rate…).

But don’t be fatalistic. If you squeeze inefficiencies out of Mexican factories, you can get great results. VF Corp’s Mexican jeans factory is highly efficient because it was organized based on “lean manufacturing” principles. They say the labor content of a pair of jeans is much lower in that factory than in any Asian factory they work with.

So then the best equation would be a more inland factory (less migrant population and I assume lower wages) paired with lean manufacturing is a perfect match?

But how does one solve the issue of raw material supply chain/lead time?

Not necessarily. One would need to look at the total value stream, from component suppliers (and maybe from raw materials) all the way to the stores. Some factories in the Pearl River delta (South of China, getting relatively expensive) are very price competitive. It depends on the industry, on the ratio of labor content in the total cost, on the importance of responding fast to market changes, etc.

Are you saying that VF Corp is making jeans cheaper in their factory in mexico than they are in China/Asia?!?!

Yes (when comparing the full cost of getting the jeans onto the US market).

But, from what I understood, they tend to make the most simple pairs of jeans (straight 5 pockets jeans) in Mexico. So the comparison might be a bit rigged.

The Mexico issue will be solved if the US can get the TPP agreement through. That’ll kick start some Mexico sourcing, especially from the US at the expense of China. There’s a good analysis of the TPP agreement here (although it concentrates more on Vietnam) the implications are the same for China:

http://www.china-briefing.com/news/2013/02/06/china-set-to-lose-out-to-vietnam-as-u-s-tpp-deal-looms.html