Three years ago, in Comparing Wages Across Asia to Make Sourcing Decisions, I showcased 2 analyses large companies tend to do before they decide on their sourcing strategy. These data are key measures of the competitiveness of producing countries.

At the time, I explained:

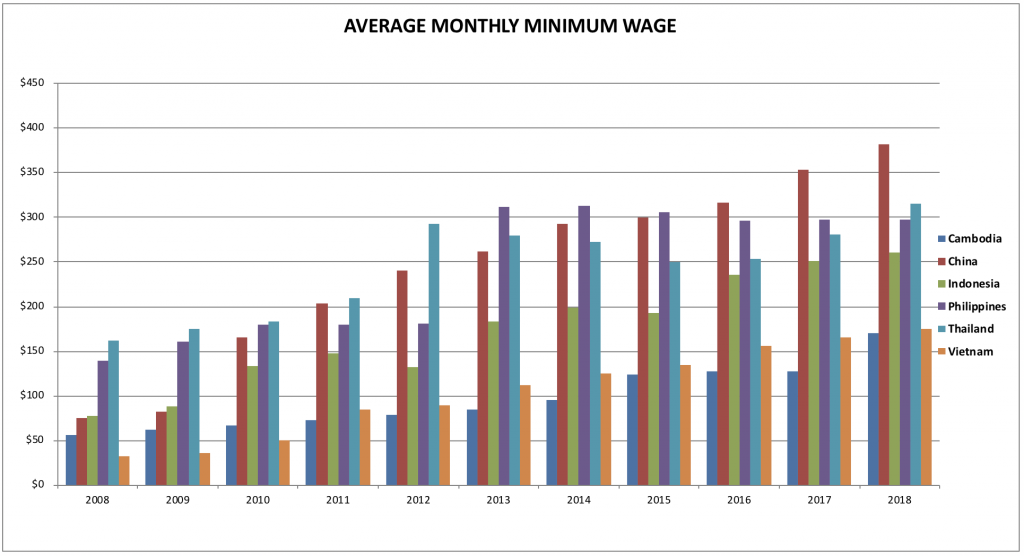

Naturally, most companies that want to compare Asian countries tend to do so on the basis of easy-to-find numbers: minimum wage levels.

The conclusion is usually “China is not competitive; the future is in Vietnam, Bangladesh, India…”. However, they often neglect two factors:

- The trend of those wages increases

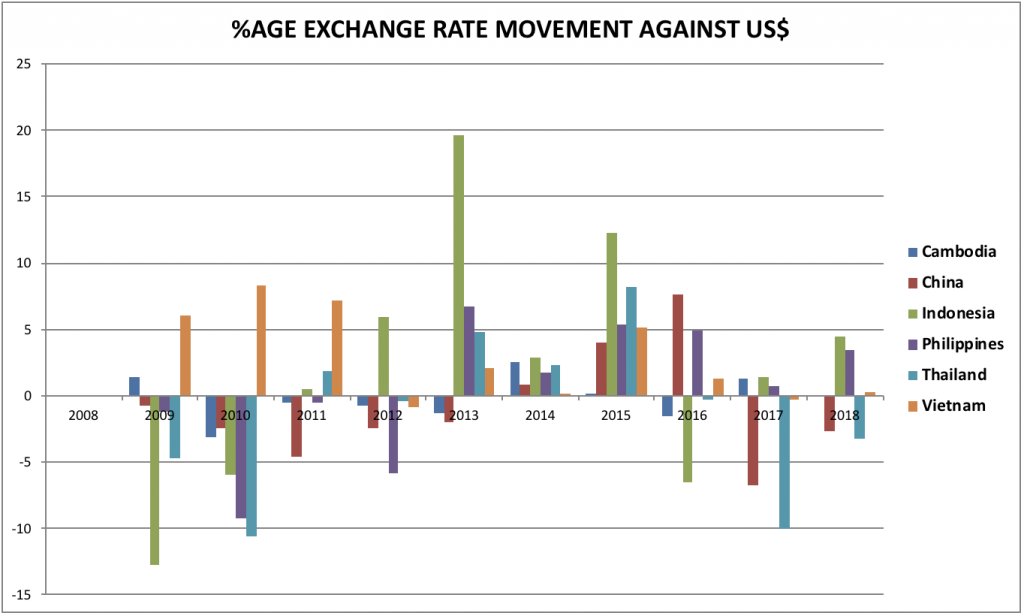

- The stability of exchange rates against the US dollar

We thought it would be nice to update the numbers, up to early 2018. Here we go.

China’s minimum wage is now the highest in the group of countries we covered. That was already predictable. No surprise here.

(The data here are not perfect. There are many ways they could be collected — for example, for China, we show the minimum wage in one of the most developed areas. What is interesting is the general trend.)

Is the minimum wage the best data we can look at, to estimate labor cost? Probably not, for two reasons:

- Most operators in Shenzhen factories earn more than the minimum wage and would do so even in a hypothetical world where they’d only work 40 hours a week.

- Chinese workers tend to be more productive than, say, Cambodian workers.

And that’s why China’s manufacturing sector seems to have lost competitiveness, but actually (overall) hasn’t. note that other countries also raised their minimum salary. I wrote “overall” because, for simple clothing and footwear, China seems to have lost competitiveness.

And the second set of data that are really interesting is…

Here are a few takeaways:

- Indonesia’s currency has taken wild swings against the USD. That’s frightening!

- Vietnam was also rather scary in 2009-2011, but has gotten more reassuring.

- China, which used to ensure the RMB followed USD closely, has gotten more volatile in 2016 and 2017. That’s not a good sign.

What do you think?

Sofeast: Quality Assurance In China Or Vietnam For Beginners [eBook]

This free eBook shows importers who are new to outsourcing production to China or Vietnam the five key foundations of a proven Quality Assurance strategy, and also shows you some common traps that importers fall into and how to avoid or overcome them in order to get the best possible production results.

Ready to get your copy? Hit the button below:

If just compare with the wages, the China is losing the competitiveness. But this just one field.

If want to know if the China is losing the competitiveness, should compare the Macro economics situation

1. such as the foreign exchange rate whether is stable,

2. the polictical if is stable,

3. the labor skills and education,

4. the infrastructure, provide the power and gas etc, and high speed way, sea port,

5. the country if have the ferfect industrial system, can provide the material with the low price .

Etc.

all of these decide the competitives of one country.

Of course, China lost the competitiveness at the field of simple clothing and footwear, these industry need the low wages labor. but the foreign exchange rate will can affect the competitiveness.

Yes, I agree. That was my point. 🙂