When choosing whether or not to source from a given country, many factors should be considered: the proximity of materials & components suppliers, the network of processing and assembly factories, infrastructure, wage levels, labor productivity, access to skilled workers, and so on.

When choosing whether or not to source from a given country, many factors should be considered: the proximity of materials & components suppliers, the network of processing and assembly factories, infrastructure, wage levels, labor productivity, access to skilled workers, and so on.

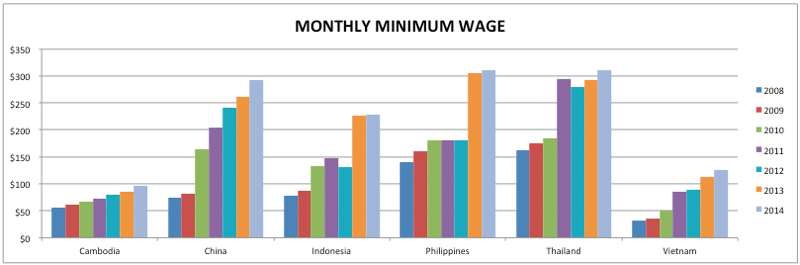

Naturally, most companies that want to compare Asian countries tend to do so on the basis of easy-to-find numbers: minimum wage levels.

The conclusion is usually “China is not competitive; the future is in Vietnam, Bangladesh, India…”. However, they often neglect two factors:

- The trend of those wages

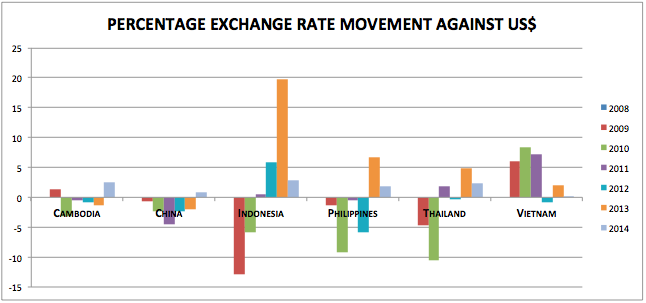

- The stability of exchange rates against the US dollar

Once you include these two parameters in the analysis, it is not clear at all why factories should leave China.

First, since China announced their 5-year plan to increase wages, other Asian countries adopted similar plans.

Vietnam has low wages, but for how long?

Second, not all currencies offer as little variation against the US dollar as the RMB:

Indonesia, the Philippines, and Thailand are particularly worrisome.

My conclusion is simple. Even easy-to-gather numbers don’t paint the picture of an uncompetitive China. Importers in most product categories are not going to leave China entirely anytime soon.

(Note: the numbers we used for these graphs are not perfect. For example, for China we took minimum wages in developed cities of Guangdong. But the trends shown on the graphs are correct.)

What do you think?

Sofeast: Quality Assurance In China Or Vietnam For Beginners [eBook]

This free eBook shows importers who are new to outsourcing production to China or Vietnam the five key foundations of a proven Quality Assurance strategy, and also shows you some common traps that importers fall into and how to avoid or overcome them in order to get the best possible production results.

Ready to get your copy? Hit the button below:

Very interesting article and topic Renaud.

I’d be interested to see how the figures compare for Taiwan. I know of many Taiwan companies who are either in the process of, or are considering going back to Taiwan from the Mainland.

Very true! I met several Taiwanese factory owners who told me the same. They can borrow at a low rate (3 to 4%) from Taiwanese banks/institutions so they plan to buy more automated equipment in order to replace workers.

But in most cases they over-estimate the benefits of automation. Some of them will have rude awakenings.

You didn’t compare with India. With a new FDI friendly budget that is really the only country that can compare in terms of worker numbers with China. And when VIetnam is in AEC compliance at the year end there will be fireworks. You tell it correctly as today but don’t tell the trend. The trend is to manufacturing more cheaply in parts of ASEAN and/or India. China wages are already 3-4 times more so your graphs (Philippines labor more than China?) are skewed. What source did you use? It’s a nice piece for China but your data isn’t right and the story about this far more complex than this.

We based the graphs on minimum wages in the manufacturing sector, from a variety of sources. Obviously the data are not perfect (I addressed this in the article) but the trends are interesting. If you have different numbers for the Philippines, please let me know.

We listed the countries that our clients mention most often. India is not part of them. Like you, I hope new FDI-friendly policies are enacted… But let’s wait and see.

This is “a nice piece for China” because the current dynamics still favor China, in many product categories. I know many importers who did serious searches in other Asian countries and couldn’t find prices competitive with China.