Two years ago in June 2020 international sea freight costs started their slow climb to unprecedented levels. No importers with supply chains abroad were safe from ballooning costs.

Shipping from any manufacturing hub was affected, China, Bangladesh, Vietnam, Myanmar, India, Turkey, and Mexico; the location just didn’t matter as long as goods needed to be loaded onto container ships and transported across the oceans.

Now, in June 2022, sea freight costs have started falling. What can we learn about this welcome situation?

Record high shipping costs

Most importers have been grappling with high costs ‘since Covid,’ but how high?

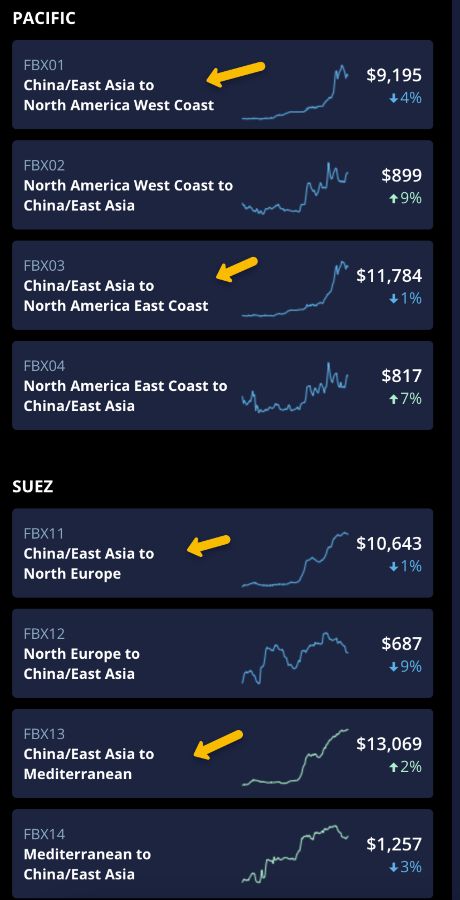

Let’s look at the Global Container Freight Index from Freightos as a guide:

After holding steady at around US$1,500 per 40-foot container on average for years until June 2020, costs rose steeply until they hit >US$11,000 in September 2021. That’s the global average. For popular routes like China/East Asia to the US West and East coasts, costs were even higher, around US$14-15,000 per container at their peak, and up to around an incredible US$20,000 if buying at spot freight rates!

🤓 We spoke to Jon Monroe a shipping expert on the Sofeast podcast about the causes of the sea freight costs in summer ‘21, so listen back to that episode to get an understanding of what caused the crazy cost increases.

A silver lining?

How about now, though? The silver lining today is that sea freight costs have been steadily falling since about November ‘21, and are now at around US$7,000. A 5x increase is better than 10x, so the costs are giving some respite to importers who previously struggled with unsustainable shipping costs for many, especially smaller businesses.

Note, however, that even now individual routes’ container costs are higher than the average figure, although not at the highs of 2021:

Why are container costs falling?

It is probably the combined effect of many factors.

- People are returning to the office and spending more on services, entertainment and eating out, instead of physical goods. This has some effect on the demand for containers which is, perhaps, not quite as high as it was when everyone was locked down.

- Factories have been busy making the standard shipping containers that are so badly needed. And shipyards have been busy making new vessels, as reported by Reuters:

In 2021, a record-breaking 555 container vessels worth $42.5 billion were ordered and 208 vessels worth $18.4 billion have been booked so far in 2022, according to the World Shipping Council, an industry group based in the United States.

Some of these vessels will be among the largest container ships ever built, stretching 400 metres in length and similar in size to the Ever Given, a cargo ship that got stuck and blocked the Suez Canal last year.

Maersk told Reuters that over the last year it had ordered 12 new large container vessels which are nearly four times the size of the Synergy Oakland.

- Lockdowns in key Chinese cities, most notably Shanghai which is home to the world’s busiest container port which was woefully affected, cooled Chinese demand for containers.

- Global growth has also been affected, first by the Covid pandemic, and now more recently by the awful Russian invasion of Ukraine which has been driving up commodity prices, oil in particular. These factors have had a dampening effect on sea freight costs.

- Shanghai is now open for business and eating though the lockdown congestion, though, and “there is a surplus of transpacific eastbound capacity, causing rates to drop, while Far East westbound rates remain stable.”

- President Biden is also waging war on shipping companies and has recently signed a law “directing the Federal Maritime Commission to prevent ocean carriers from unreasonably refusing to fill open cargo space with US exports [instead choosing to send empty ships back to Asia quickly to fill with exports to the States again, harming American exporters,] and to investigate late fees charged by shippers. Biden said the law would “at least marginally” reduce inflation. It doesn’t directly address elevated shipping costs that American importers and exporters have long complained are the heart of the problem, though backers of the bill predicted it would have an overall chilling effect on prices.”

What could cause prices to rebound?

Countries’ economies are roaring back into life, in the West at least, after Covid health restrictions like lockdowns and other measures have largely been dropped. This has kept demand for shipping high. The shipping companies won’t willingly wish to lower prices too much while demand remains very high.

We must consider that shipping companies suffered from heavy losses following the global economic crash of 2008 and suffered from all the cards being in the hands of buyers. The more cynical among us may argue that they’ve used the period of high demand during and post-Covid to claw back some of those losses in the form of extortionate prices…will they want to give that up?

According to Reuters, we aren’t out of the woods completely yet. They state that:

“Global port congestion is set to continue until at least early 2023 and keep spot freight rates elevated [and that] the COVID-19 outbreak has lengthened ship delivery times since 2020, pushing up freight costs, while the Russia-Ukraine conflict and lockdowns in Shanghai have added to supply chain disruptions this year.”

While shipping companies have been demonised, perhaps fairly, for raising prices so much, another issue that could affect costs moving forward is the lack of investment into land-side infrastructure:

“As long as America’s ports, rail yards and warehouses remain overloaded and unable to cope with the increased trade levels, vessels will remain stuck outside ports to the detriment of importers as well as exporters,” the World Shipping Council said. “Ocean carriers continue to move record volumes of cargo for our country and have invested heavily in new capacity — America needs to make the same commitment and invest in its land-side logistics infrastructure.”

This drives up demand, delays, and costs, and the shipping companies argue that they can’t be held responsible for that.

🤓 We discussed port-side difficulties in the USA with logistics expert Marshall Taplits in this episode of our podcast.

How to protect against volatile shipping costs?

Taking positive action seems to be the key strategy. The Reuters article suggests that “more than 60% or 65% of shippers were remaining on spot rates…[and] are not taking measures to deal with the new situation, this means they are prone to full supply chain risks.”

Rather than buying spot rates, it’s advised for “charterers [to] sign longer-term contracts with shipowners to overcome issues of volatile cost and availability. It’s no longer a case of going for three months or six months, one month, not even one year, but two to three years … because we want certainty in cost and certainty in space.”

Businesses shipping a lot may be able to negotiate a longer-term contract with freight forwarders or shipping companies due to the amounts of cargo involved. There have also been cases where corporates have been chartering their own ships, too, such as Walmart, Costco, Target, and others.

Businesses have also been altering their sourcing strategies to focus on reshoring or at least near-shoring, rather than having suppliers in East and Southeast Asia. This is only realistic for companies who are actually able to source the necessary components and materials in a nearby country, which may be possible for some products but certainly isn’t for most electronics. Companies who achieve this can benefit from reduced shipping costs, shorter lead times, and less need to keep as much money tied up in inventory over shipping from, say, China.

You may decide to buy components in bulk to keep them as inventory and avoid the need to ship as often.

Finally, using DfX principles to optimise product and packaging design for shipping (Design for Shipping) could help you shave kilos off the weight of one product unit to be shipped and help squeeze more into a single container if the packaging is able to shrink while still providing the same protection. This enables you to get better value from the same costs.

******

How have you dealt with high shipping costs? Have the reduced prices made a big difference? Have you considered sourcing and assembling in different countries to reduce the need for such a long supply chain? Let me know by contacting us or commenting, please.

8 Elements of a Low-Risk Supply Chain in China

This FREE webinar will empower you to transform your supply chain in China to reduce risks. Two industry experts, Renaud Anjoran and Paul Adams from Sofeast, talk you through how to gain control over your product’s quality, on-time shipments, long-term pricing stability, and continuity of supply.

Ready to watch? Register by hitting the button below: