In March (2021), we noted that the raw material prices of some commodities (silicone, some papers & cartons, some batteries…) went up a lot.

And some analysts predict a multi-year increase in raw material prices.

Bloomberg came up with an interesting article on this topic — When Does a Commodities Boom Turn Into a Supercycle?:

A surge in commodity prices has Wall Street banks gearing up for the arrival of what may be a new supercycle — an extended period during which demand drives prices well above their long-run trend. A major impetus is the massive stimulus spending by governments as they juice up their economies following pandemic lockdowns. The evidence includes surging copper and agricultural prices and oil back at pre-Covid-19 levels. One theory is that this could be just the start of a yearslong rally in appetite for raw materials across the board, but the reality is more complicated.

The prices of copper, tin, cotton, and many other commodities have been going up. And this comes on top of sky-high shipping costs that may not go down this year.

Here is one of the most obvious examples, copper:

I remember the same situation of rising prices came up after the 2008/2009 crisis and many importers suffered.

If those analysts are correct, it means the prices you will pay to have your products made are going to go up. If you do nothing, your margins will suffer or even disappear.

(By the way, buyers of electronic products have already been suffering for 6 months with, in some cases, some insanely high prices. They might also need to reflect on their business models.)

6 approaches to combatting raw material price rises

What are the strategies you can follow to combat increasing raw material prices? I tried to come up with a shortlist of 6 approaches that might make sense for you:

1. Basic sourcing: always looking for cheaper suppliers

This one makes sense in some industries. Most apparel buyers seem to always be looking for the ‘cheapest needle’, all the way to Myanmar (which is going through a severe political crisis) and East Africa.

In many industries, the gains from this approach are negligible. Manufacturers of commoditized products already operate on thin margins and can’t give more concessions.

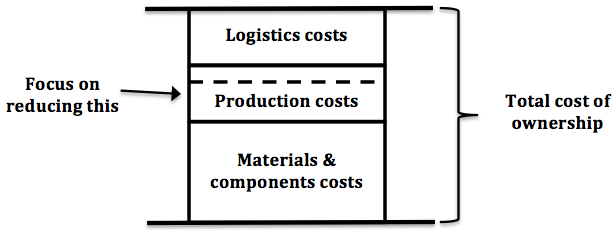

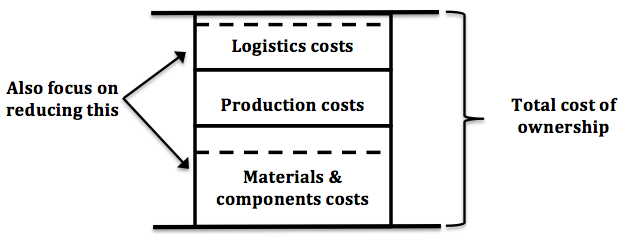

As the drawing below suggests, there are other ways to cut costs.

(By the way, if you are working with suppliers that are causing all sorts of cost overruns on your side, you do need to look for more reliable sources. Sometimes, paying an extra 5% and getting better performance is a great deal.)

2. Re-engineer the cost drivers without removing the value your customers are willing to pay for

Take a more holistic view of the costs:

Try to think of ways to redesign your product itself with a different structure, different materials & components, without unneeded features, and so on.

That’s what they call ‘value engineering’.

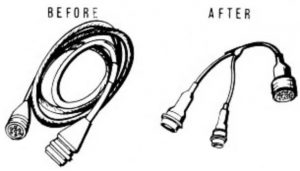

Here is an example from GE in the 1960s:

In the original design, custom molding was required and six types of cable assemblies were used. Typical costs for one type was $250 each […]. After value analysis was used, the leads, breakouts, and connectors were assembled using oversized tubing, then heat-shrink tubing was used. Typical costs for each unit fell to $100 […].

The production process might be unnecessarily expensive. Maybe your metal parts are CNC-machined out of a block of material, while some competitors use die casting with a bit of CNC finishing. Their unit cost may be 35% lower than yours.

Take a hard look at the packaging, too. Is it unnecessarily bulky and complicated? Sometimes, a thinner, more compact packaging protects the product better. (Read about an example here.)

And look at logistics – for example, using slip sheets instead of pallets to save on volume, working with regional distribution centers, etc. There are often many unexplored ways to save money.

3. Strategic sourcing: working closely with key suppliers

This approach works particularly well if you develop new products and you have an open and productive relationship with key suppliers that contribute engineering resources and ideas.

I wrote about this before. Ikea realized cost savings between 5 and 15% by following this approach. Chrysler set up a system in the 1990s that generated more than a billion USD of annual savings.

4. Make a leap from ‘buying’ to ‘making’

Maybe your sales are not very seasonal and the manufacturing of your product (at least their final assembly) does not require very expensive equipment or deep know-how. Starting at a certain level, you might generate substantial benefits by handling the manufacturing yourself:

- With good process engineering, you might be able to make the products at a lower cost

- The location of your factory may be closer to your main market, leading to shorter lead times for your customers and a more upscale image (“it’s not made in China”).

- Over time, by controlling manufacturing, you might find ways to improve your processes and your products in a way that brings more value to your customers and/or cuts your costs.

- If you tend to make customized equipment, being closer to your market means being better able to problem-solve and bring unique solutions.

5. Differentiation: a way to raise your prices over time

Raising your prices may be impossible if you sell the same product to retailers or even directly to consumers. You might actually be forced to decrease your prices!

The solution is often to develop new versions of your key products:

- If you sell to consumers, find a source of dissatisfaction with existing products (read reviews on Amazon, etc.) and find a way to avoid that.

- If you sell to businesses, know more about their needs, and find a way to provide more value, typically with a new feature(s).

Make sure to read my guide to new product manufacturing, to avoid the most common pitfalls.

6. Niche marketing

Not only are costs going up, but Chinese companies are becoming better at selling directly on your market. B2C marketing is a serious weakness of most manufacturers here, but more and more specialists are helping them set up a Kickstarter campaign, an Amazon account, and so on.

What is a key advantage that they don’t have? An understanding of the segments of your market, and the ability to pick the right message to reach some of those segments.

******

Are rising raw material prices affecting your business? What measures are you taking to combat them? Let me know in the comments, please.

Are you designing, or developing a new product that will be manufactured in China?

Sofeast has created An Importer’s Guide to New Product Manufacturing in China for entrepreneurs, hardware startups, and SMEs which gives you advance warning about the 3 most common pitfalls that can catch you out, and the best practices that the ‘large companies’ follow that YOU can adopt for a successful project.

It includes:

- The 3 deadly mistakes that will hurt your ability to manufacture a new product in China effectively

- Assessing if you’re China-ready

- How to define an informed strategy and a realistic plan

- How to structure your supply chain on a solid foundation

- How to set the right expectations from the start

- How to get the design and engineering right

Just hit the button below to get your copy (please note, this will direct you to my company Sofeast.com):