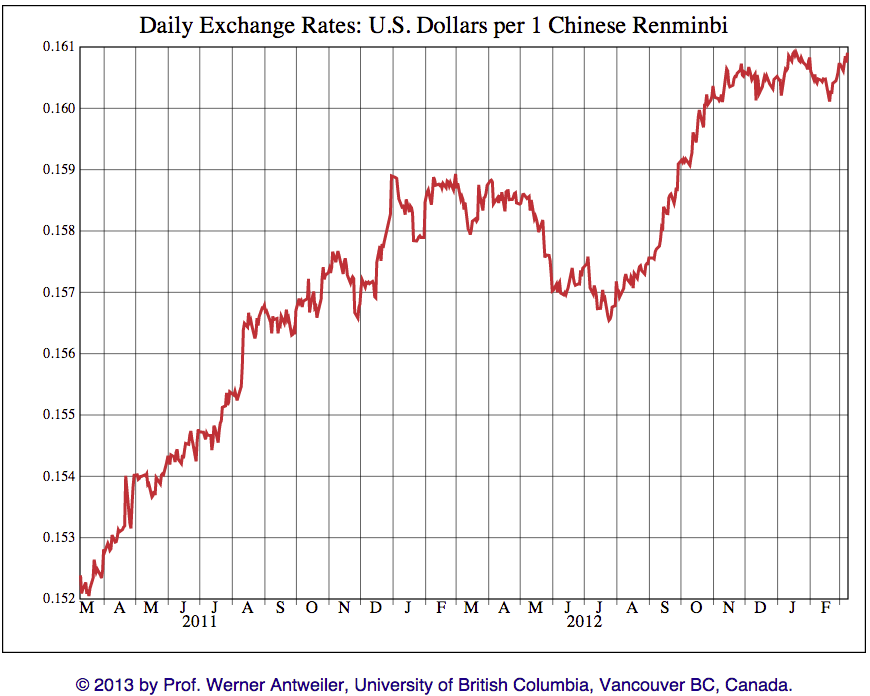

Have your margins been beaten up by the strong appreciation of the RMB? There is hope in the short and medium term.

For a bit of perspective, here is the RMB/USD exchange rate over the past two years:

This past week I attended the ”Made in Asia” seminar organized every year by the French Chamber of Commerce in Hong Kong. A couple of speakers mentioned some thought-provoking data that I am presenting below.

Financial markets currently expect the RMB to go down

Bruno Francois, Head of Global Trade Solutions Greater China for BNP Paribas, told us something very interesting. If you commit now to purchase RMB in 6 months (for paying a supplier, for example), the rate is lower than if you buy RMB now.

It means you’ll actually earn money, by paying less USD for 1 RMB in 6 months than it would cost you right now. This should be VERY interesting to importers, who already know they will have to pay Chinese suppliers in 3 or 6 months.

Not to mention, all Chinese exporters are anticipating a rise of the RMB. So, if you promise a payment in RMB and if the RMB rises less than they expect, you will also pocket a difference.

SIDE NOTE:

According to Mr. Francois, paying suppliers in RMB necessitates a transition in the buying organization. It impacts your purchasers (what to respond to suppliers’ questions?), your IT system, and your processes (asking for dual quotations, in RMB and in USD). The transition takes easily 6 months, and afterwards it is hard to go back.

Why the RMB might go down

Keith Bradsher, Hong Kong Bureau Chief for the New York Times, explained how China’s economic policy is pushing inflation up and should keep the RMB rate down.

China’s economy is about half that of the United States. Yet the amount of money supply (what economists call “M2”, to be precise) is now larger than that of the US!

The reason is simple. China’s central government is trying to keep its economy humming. Over the last 5 years they noticed that, as soon as credit gets tight, growth stops (and, at one point, the GDP even went down for a few months). So they have to inundate their economy with cheap money.

More money supply means higher inflation and weaker RMB.

The question is, at which point will inflation become a big problem for most people (and when will it become out of control)? And when will they have to push the RMB up again to reduce the cost of imported materials, and help curb inflation? These are not simple phenomena.

Mr. Bradsher also thinks there is going to be less pressure from the US for a rise in the RMB. That’s a political consideration and I trust he knows more about this than I do!