QualityInspection.org

Quality Assurance, Product Development, and Purchasing Strategies in China

QualityInspection.org

Weekly updates for professional importers on better

understanding, controlling, and improving manufacturing & supply chain in China, India, Vietnam, and elsewhere in Asia.

Practical advice for importers about quality control & sourcing. And see 1,000 articles & videos (100% free).

Hi, my name is Renaud Anjoran. I have been working in China since 2005, mainly in quality inspections, factory audits, and manufacturing improvement projects.

Since 2015 we also help our clients with project management and engineering services - what it takes to develop their new products in good conditions.

I have been blogging about this for 10 years. Some of the most useful articles are featured below.

Read Our Latest Blog Posts

- How did China become a global technology leader, and where are they headed?

- Switch Away from a Manufacturer at the First Signs of Trouble

- 10 Horror Stories Buyers from China Face (and How to Overcome them)

- Why Quality Fade Is A Danger We May Not See Coming

- How to protect PCBAs in electronic products?

Are you buying products from China, Vietnam, or India?

As you might already have noticed, everything you do has an impact on quality and compliance. Let me share some tips with you depending on where you are in the process (hit the links to learn more about each topic).

When you set up your supply chain

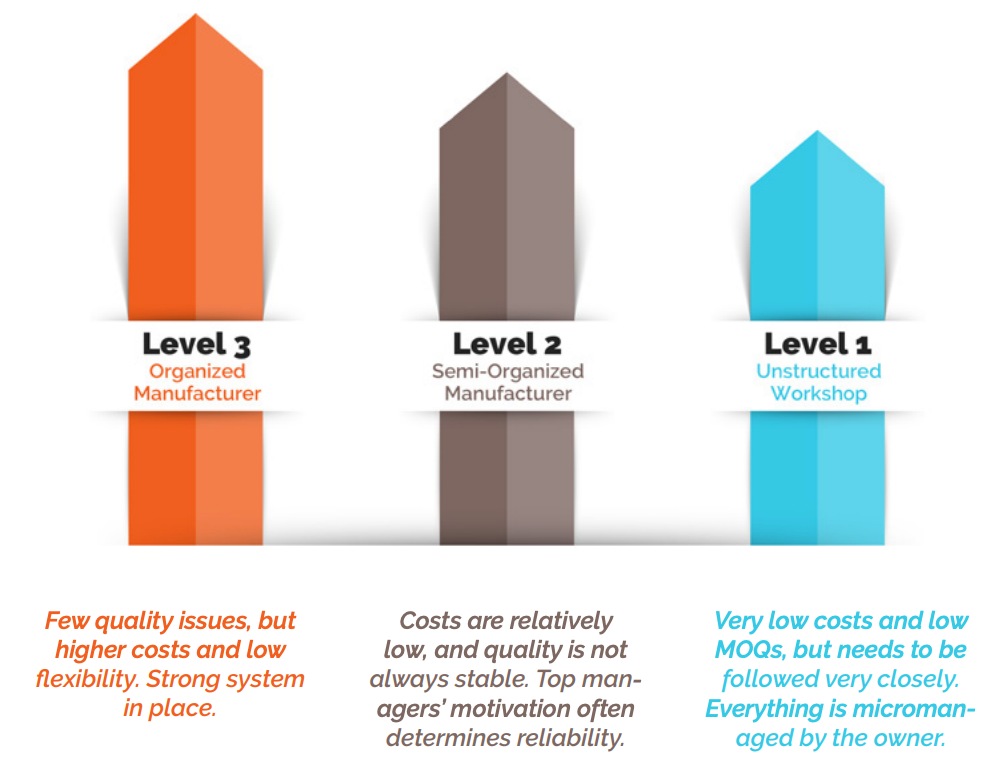

You need to work out what type of supplier you are working with:

- Typical Chinese factory (OEM / ODM)?

- Trading company?

- Contract manufacturer?

- How large are they, and how mature are their systems & processes?

Payment terms

What payment terms are you agreeing on, and are you having suppliers sign enforceable contracts? All this will help you keep leverage in your hands.Supply chain visibility

Do you have visibility over the suppliers of critical components/materials?Supplier performance and development

How do you keep track of supplier performance (quality, on-time delivery, cost, service) and challenge them to improve? Can you trust them to self-inspect?When you buy products

Samples

Do you approve samples that must be representative of mass production? Do you also define your quality standard and specifications (in the form of a checklist)?Quality inspections

Do you send QC engineers (at least at the final inspection stage) to confirm that production is acceptable? After shipment, there is probably nothing you can do if you get bad quality.Certifications and lab testing

Do you keep in mind the need for certifications and/or laboratory testing, to be compliant with regulations?If you develop new products

Product development

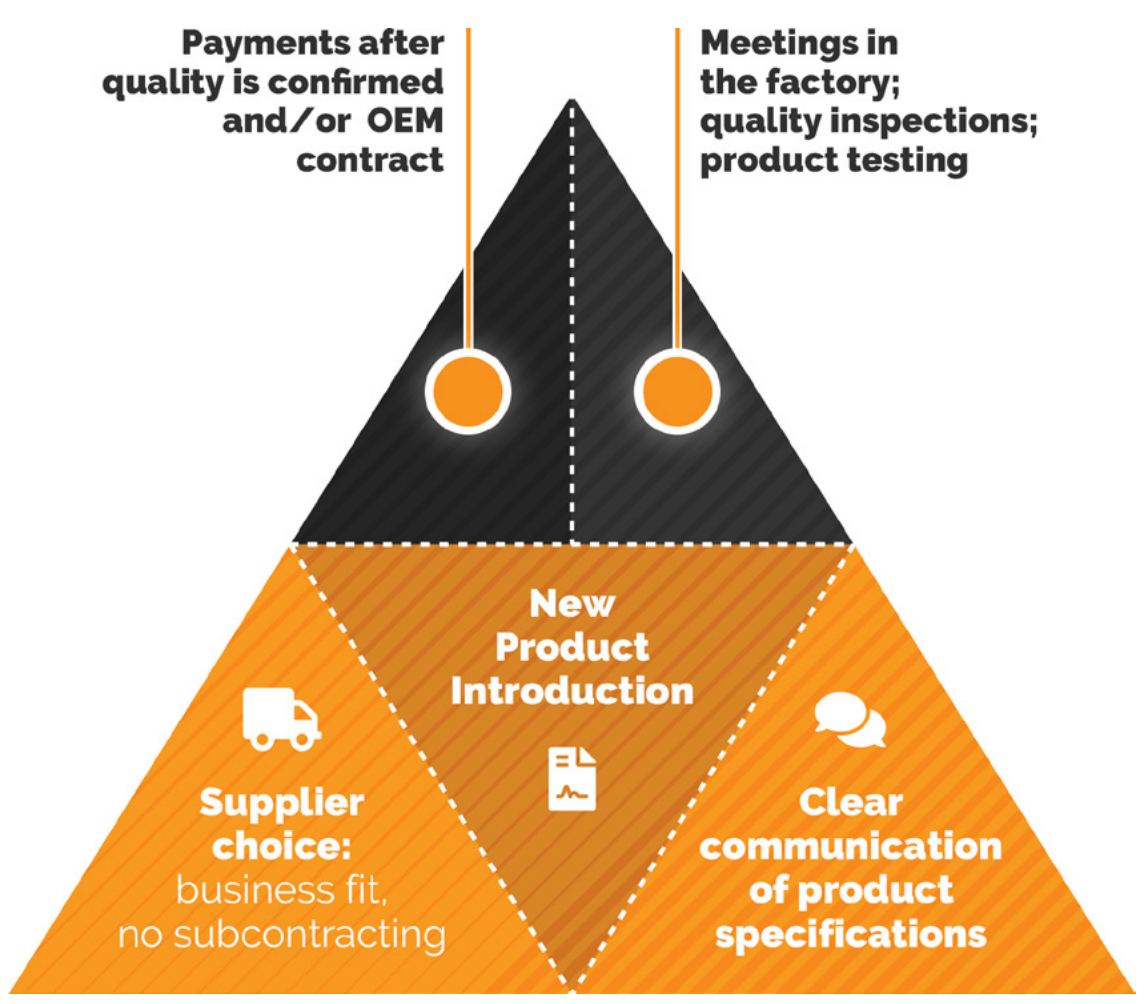

Do you manage the development process? Or do you let the supplier handle it all (the more complex the product, the more dangerous this approach is)?NPI

If your new product is complex, do you follow a good 'new product introduction' process, from design reviews to small pilot runs?