More and more buyers are being scammed into wiring tens — sometimes hundreds — of thousands of dollars to the wrong bank account.

More and more buyers are being scammed into wiring tens — sometimes hundreds — of thousands of dollars to the wrong bank account.

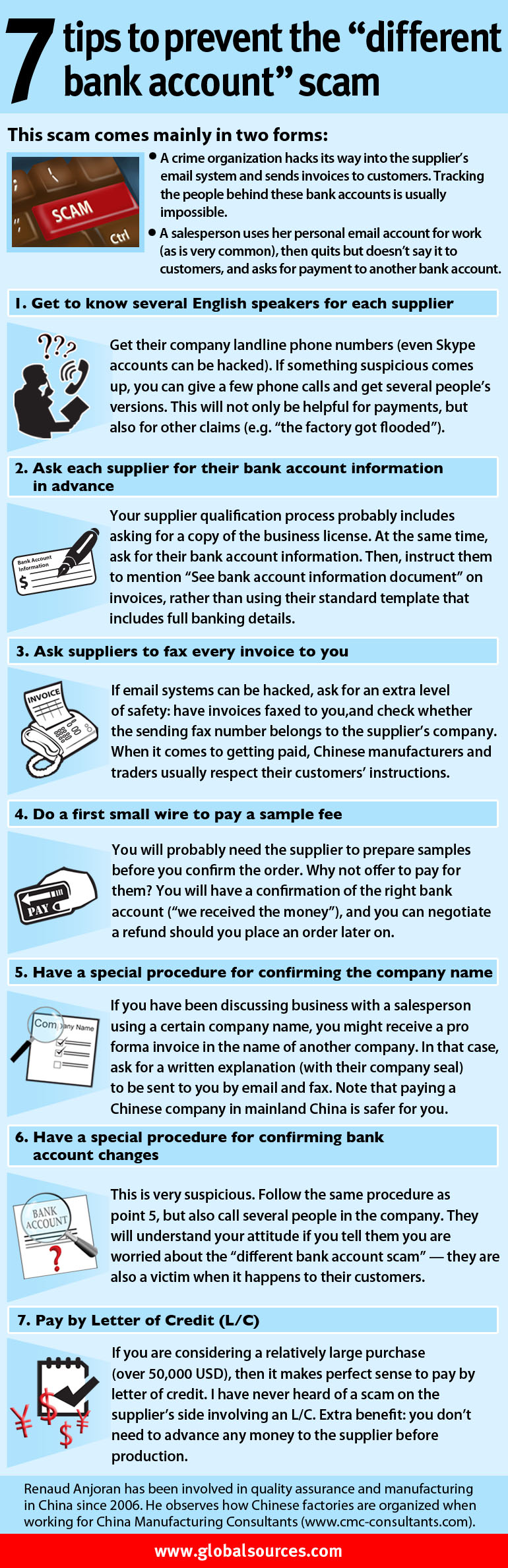

I helped Global Sources prepare an infographic on how to reduce this risk:

This scam comes mainly in two forms:

- A crime organization hacks its way into the supplier’s email system and sends invoices to customers. Tracking the people behind these bank accounts is usually impossible.

- A salesperson uses her personal email account for work (as is very common), then quits but doesn’t say it to customers, and asks for payment to another bank account.

There is no silver bullet to avoid this scam, but using a combination of appropriate tactics makes it very unlikely to work.

1. Get to know several English speakers for each supplier

Get their company landline phone numbers (even Skype accounts can be hacked). If something suspicious comes up, you can give a few phone calls and get several people’s versions. This will not only be helpful for payments, but also for other claims (e.g. “the factory got flooded”).

2. Ask each supplier for their bank account information in advance

Your supplier qualification process probably includes asking for a copy of the business license. At the same time, ask for their bank account information. Then, instruct them to mention “See bank account information document” on invoices, rather than using their standard template that includes full banking details.

3. Ask suppliers to fax every invoice to you

If email systems can be hacked, ask for an extra level of safety: have invoices faxed to you, and check whether the sending fax number belongs to the supplier’s company. When it comes to getting paid, Chinese manufacturers and traders usually respect their customers’ instructions.

4. Do a first small wire to pay a sample fee

You will probably need the supplier to prepare samples before you confirm the order. Why not offer to pay for them? You will have a confirmation of the right bank account (“we received the money”), and you can negotiate a refund should you place an order later on.

5. Have a special procedure for confirming the company name

If you have been discussing business with a salesperson using a certain company name, you might receive a pro forma invoice in the name of another company. In that case, ask for a written explanation (with their company chop) to be sent to you by email and fax. Note that paying a Chinese company in mainland China is safer for you.

6. Have a special procedure for confirming bank account changes

This is very suspicious. Follow the same procedure as point 5, but also call several people in the company. They will understand your attitude if you tell them you are worried about the “different bank account scam” — they are also a victim when it happens to their customers.

7. Pay by Letter of Credit (L/C)

If you are considering a relatively large purchase (over 50,000 USD), then it makes perfect sense to pay by letter of credit. I have never heard of a scam on the supplier’s side involving an L/C. Extra benefit: you don’t need to advance any money to the supplier before production.

Maybe some readers have other tips?

—

If you have been scammed in this manner, maybe your insurance will have to compensate you. Read this post on China Law Blog (last 3 paragraphs) for more information.

Great tips! Do you also hear about scams with Alibaba manufacturers?

Yes of course. There have been scams with those guys for years. And the victims of these scams tend to be small buyers with little experience buying in China.

With the “different bank account” scam, many savvy importers have been hurt. That’s a scary one.

Hey Renaud, nice article! Basically if a sourcer follows your list they will be pretty covered from most opportunistic scams. Even a hacked invoice can be thwarted with some redundant communication. I don’t have much experience with L/Cs, normally the suppliers I’ve dealt with refuse to accept a performance clause. My previous company was concerned that the L/C would end up tying up our funds for a long period and the supplier gets still gets paid if they underperform. Have you ever had experience with a contested L/C?

I am not sure what you call a “performance clause”.

And what do you call a “contested L/C”? Contested by the buyer? In 99% of cases there are discrepancies so the buyer has the power to refuse payment — why would he contest the L/C? After authorizing payment and receiving the goods?

I never heard of this scam, but with payments and changes of bank account numbers / banks. What I would do is this:

1. Confirm the bank account number by phone. Just call your supplier (accounting or finance department) and confirm the (new) bank account number i.e. if there has been a change in bank account / bank.

2. If point one does not already solve the potential issue, you may check the bank to which the new account number belongs. Does the number belong to the name of your supplier.

3. In general: always be suspicious when sales people provide this kind of information or instructions. Usually this kind of changes is not only rare, but it is usually spread via the accounting / finance department (not via sales).

4. Check any changes on the company website.

LC looks nice, but it is expensive and not really necessary if you already have established a good trustful relationship.

Good ideas. I had not thought of checking with the bank — I assumed they wouldn’t confirm this to a random person.

Great tips! Thank you, Renaud, for creating this clear infographic.