I often have to remind buyers that they are not necessarily seen as a big and profitable customer by their Chinese factories.

I often have to remind buyers that they are not necessarily seen as a big and profitable customer by their Chinese factories.

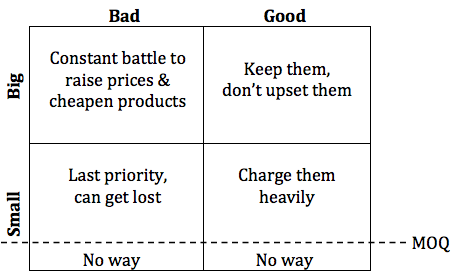

I drew this graph to illustrate the way suppliers often see their customers:

Some customers are “big” or “small”: nothing surprising, I guess. If you represent 3% of the factory’s annual capacity, your orders are certainly not their top priority.

But there is another dimension: “good” vs. “bad”. I wrote about it two years ago, in the way Chinese factories view their customers.

Here are excerpts from that article.

What constitutes the complete profile of the “bad customer”?

- A constant bargainer, who shops around and switches suppliers easily and frequently

- An intermediary such as a trading company, rather than a direct oversea customer

- Very strict requirements, systematic control points, and penalties for discrepancies

- A weak commitment to payment, such as a letter of credit with “soft terms”

- A bad reputation, such as rumors of cancelled shipments reported by other suppliers in the same city

- Rather complex products that consume the attention of management

How are “bad customers” treated?

- Price negotiations are harder

- Generally speaking, every order is treated as a one-shot deal. No unnecessary effort on anything!

- The temptation to substitute substandard materials is much stronger

- Products are manufactured in the lines with the least experimented workers, and QC is minimal

- A junior merchandiser is assigned to follow the order, often without close supervision

- Samples are not prepared in priority, and if possible not by the most skilled technicians

- Whenever a “better” customer has an urgent shipment, production takes longer

So what is the sweet spot? Find a manufacturer for whom you represent 20-40% of annual capacity (and this will be hard if you place small orders), and treat them well…

Do you agree?