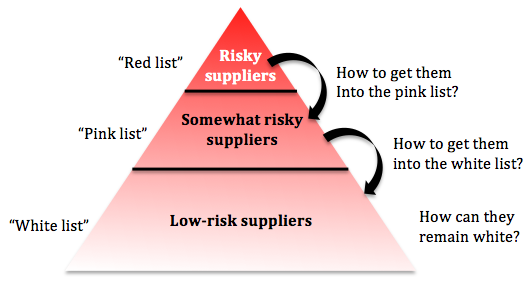

Three weeks ago I wrote How to improve your Chinese supplier pool?, where I argued that importers should distinguish 3 categories of suppliers:

Three weeks ago I wrote How to improve your Chinese supplier pool?, where I argued that importers should distinguish 3 categories of suppliers:

I also posted it as a discussion on cha1n.com (a social network for supply chain professionals), and I got a really interesting comment by Andreas Willms. He explains how his company has managed its Chinese suppliers development. I am reproducing it below.

***

Yes, I completely agree with you. Even under total-costs view, supplier development is worth it in many cases. Your shown measurements for each group are reasonable. But some points are open.

It is important that your grouping is reliable, objective and clear. How do you group your suppliers? We learnt to do this by hard facts; we don’t consider any soft facts anymore.

Hard facts could be delivery and quality performances as ppm, audit results and even price levels, etc. Indicators need to be defined for each and an accurate way to measure them must be found. Then you have to weight them and get a final number, points or percentage as result. We have 75% and 85% as the 2 limits between your named red, pink and white area.

The most important lesson we got is the importance of the right presentation to the maker. You can speak during dozens of lunches for hours about it, but a simple paper on the table with some clear words are worth more than all these discussions. The GM of a SME may be very impressed to receive a paper with a formal warning and consequences (reduced volume, stop of new inquiries, price surcharge, punishments, etc). They will ask how it came to the result and you can decide how much info you like to provide about. Later he can put your formal warning on the table in their internal meeting and demand improvements by his managers.

Of course you can give regular updates about their performance or provide certificates for the best supplier — or even invite the best ones to a “supplier day”. There are many ways to play this, but all need work and must be considered wisely.

Returning to your measurements. Assuming that you don’t have endless resources you better define the suppliers who are worth all this time, energy and costs. A diagram with turnover and strategic importance will help you to concentrate on the important makers to start with and concentrate on.

Because to my opinion you can develop any supplier – who is willing to – to nearly any level. But you should consider who is worth the work; else potential savings perhaps not even cover the costs of it (in case the supplier does not commit strongly).

Last no least, it only works if your colleagues are actively pushing and following up. We are currently trying this by putting the average performance of the supplier they are responsible for in the annual targets. Besides this, we explicitly fix targets for key suppliers. Since we have the historical evaluation results of the suppliers, we can define the individual targets based on the past.

To set up an evaluation system is work, but once you have it could give you an objective picture of the performance of each supplier. Then you could start to develop as stated by you and see the results of your efforts.

Develop suppliers is very important and necessary. Usually, the suppliers can do better than they did, so the buyers must give their details requirement to suppliers and follow up.

Yes, and it is not only a communication issue. Sometimes the client (or a consultant helping the client) has to step in and reorganize the processes one by one.

train and make the supplier improve is also very important