Clients often ask us what their incoterm options are when it comes to shipping by sea. Our typical answer is “most buyers go for FOB, so that’s probably what you want to do”. But that’s a bit short. Let’s look in more detail at how to select the right option for our needs from all the Incoterms 2020 list.

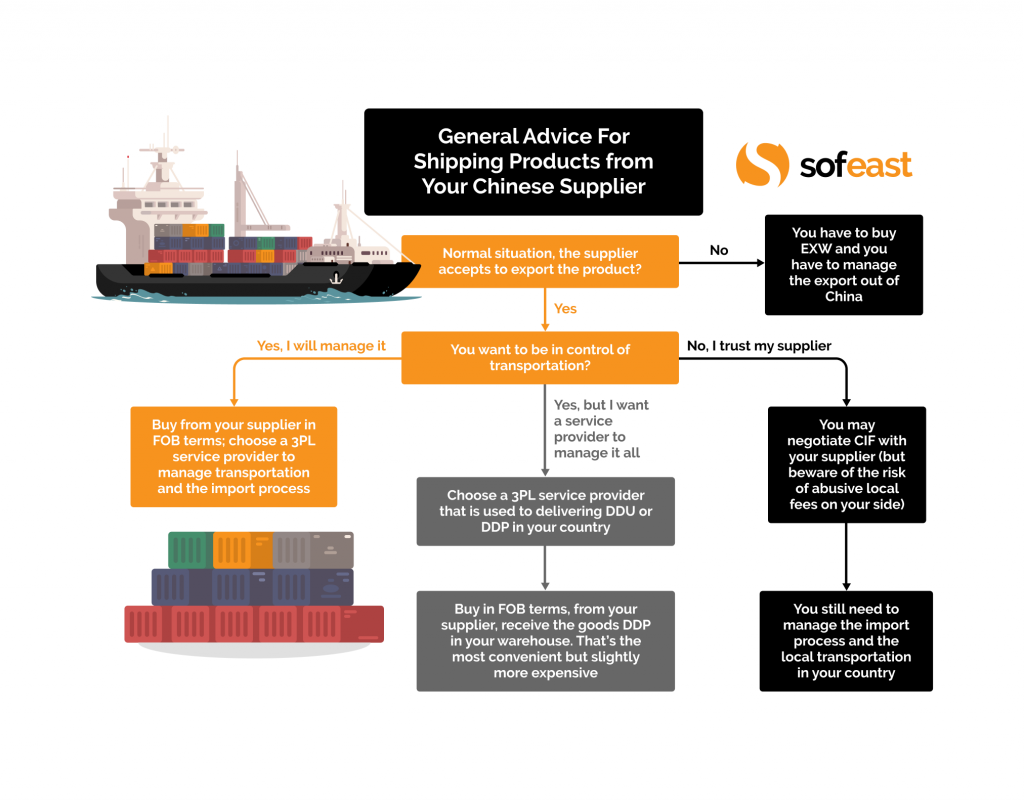

Advice on incoterms for shipping products from your Chinese supplier [Flowchart]

To provide a bit more insight into the main incoterm options, we prepared this flow chart:

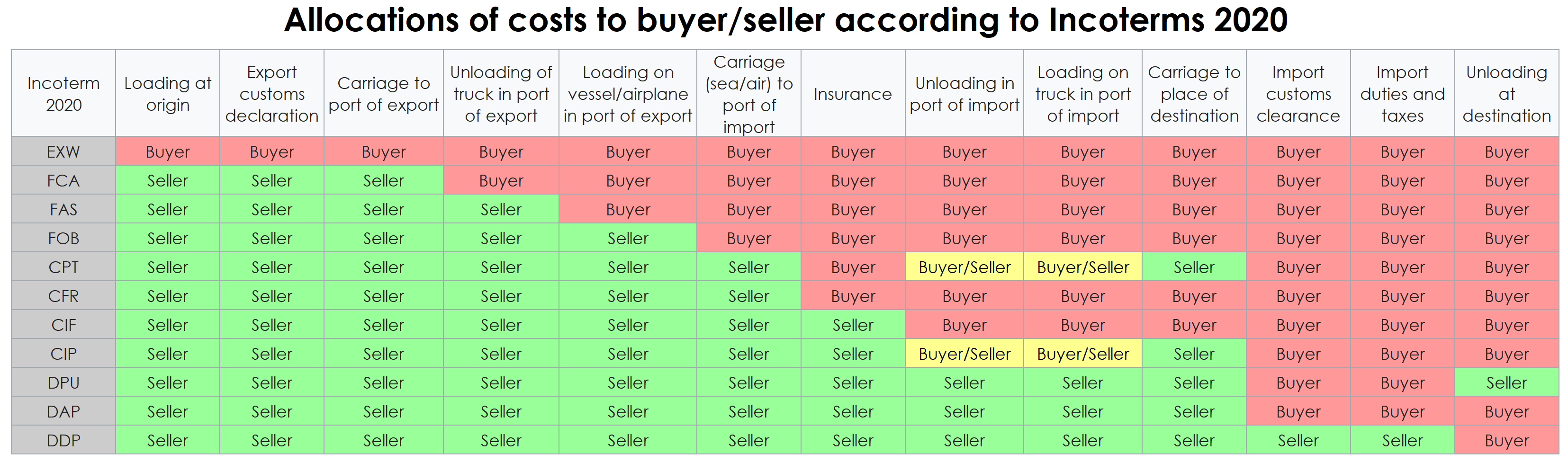

Also, to give you a clearer idea of how costs and responsibilities are allocated for each incoterm, see this chart:

Buying FOB

In general, importers buy in FOB terms. For example, if the products are made in Dongguan and are shipped in the Shenzhen Yantian port, they usually write “FOB Shenzhen” on the purchase order. There are three important benefits here:

- The supplier has to handle the export procedures out of China, apply for the VAT rebate, etc.

- The buyer can choose the freight forwarder that will manage the sea shipment. If a route is a bit faster but slightly more expensive, they can choose that option. (If the supplier makes that decision, they will tend to choose the cheapest route).

- The buyer has a lot of information and power. The freight forwarder releases the shipping order to the supplier after the buyer’s green light. The buyer knows when the goods are shipped out. The buyer knows if there is an issue, without relying on the supplier. And that is related to T/T payments — in many cases, the final payment is sent only after the bill of lading has been released by the appointed forwarder.

Buying EXW

Last year, with the PPE craze, many suppliers refused to export the goods. They had so many buyers lining up at their door, they found it convenient to sell EXW. That was a very special situation, and we hope never to see that again. The buyer had to work with another Chinese company that had an export license and could process the export of the goods.

EXW shipping provides buyers with complete control over their shipping, is good for dropshippers (who can export each order individually), and yields a lower unit price from suppliers who don’t include certain costs they’d usually pay. However, it puts a huge cost and liability burden on buyers, as the responsibility for the goods transfers to you as soon as the supplier makes them available at their premises. You’ll also need to be able to handle the domestic freight and any issues that may occur while the products are en route to the port, even if you’re very far away and in a different time zone.

Buying CIF

We regularly hear of importers who are happy because they buy under CIF terms. But they seldom keep buying CIF in the long run, as there are many cases of abuse, as I wrote before. You really need to trust your supplier a great deal, at least much as your own freight forwarder. And you will still need to manage the import on your side.

This may be most suitable for less experienced importers who don’t yet have the contacts to handle arranging shipping and insurance in their supplier’s country. Letting the supplier handle it provides peace of mind, but, of course, there’s a risk that they may choose services that aren’t as cheap/safe/suitable as a freight forwarder would.

Buying DDU or DDP

If you don’t want to have to manage the process at all, you can work with a 3PL firm to receive the goods in DDU/DAP or even DDP terms. When shipping using both of these incoterms the seller will pay all or almost all costs to get the goods to your port aside from the final unloading. To be clear, with DDP for example, the buyer will know that when the shipment arrives they won’t be obliged to pay any additional fees to customs. Since the supplier has paid all of the transportation, sea freight, and customs charges, there should be no unpleasant surprises, but the cost will also be higher than FOB. DDU (or DAP as it’s now known in Incoterms 2020) is the same except that the customer will only pay the customs fees to import the goods once they’ve arrived with the seller covering everything else.

That’s the most hands-off and convenient approach. We have been organizing that for some of our clients for years, and we have to admit it always comes out a bit more expensive than in the ‘typical’ FOB scenario. Don’t go for this if you are very sensitive to a 5-10% difference in cost.

Conclusion

This is based on the latest version (Incoterms 2020). There are a few more options, of course, but they are seldom used by importers moving products in sea containers. They don’t make much sense.

If you know exactly what you are doing, you can of course define your own shipping terms. The Incoterms 2020 are just ‘pre-packaged’ terms, to simplify people’s lives, but there are actually an infinite number of variations.

You can even write “FOB Incoterms 2000” on your purchase orders if that makes more sense. (I would not suggest doing that in 99.9% of cases, though.)

P.S.

You can learn more about all of the incoterms 2020 available here: Incoterms: What are they?