I had the opportunity to ask a few questions to Richard Bensberg, an expert in the field of international transactions. Richard is CEO of Remitsy, a payment service provider for global commerce. His focus is on enabling British and European companies to make cheaper and quicker payments to China.

I had the opportunity to ask a few questions to Richard Bensberg, an expert in the field of international transactions. Richard is CEO of Remitsy, a payment service provider for global commerce. His focus is on enabling British and European companies to make cheaper and quicker payments to China.

Q: Can you describe the process steps involved in a typical bank wire from an importer to their Chinese supplier?

I think it’s fair to say that there still isn’t anything resembling a “typical payment”. How a payment is processed still varies greatly depending on the input and output currency; the countries involved; and the banks used to make and receive the transaction. Whilst domestic payments (or payments within a union such as the EU) are generally quite efficient, international payments use the SWIFT network, which is slow.

SWIFT was originally built in 1973 – long before the creation of the Internet. When money is sent overseas, physical assets don’t have to move. Instead, SWIFT acts as a messaging system between banks to clarify the ownership of assets on their books.

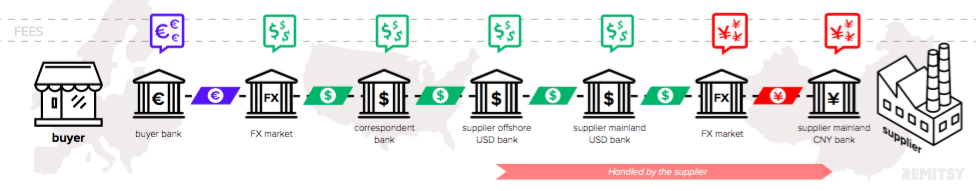

Traditionally the US Dollar has been used as the currency of choice for the export industry in China, and suppliers will often invoice in USD. If you are a European company receiving Euros from your customers that means the payment process can look very daunting.

Euros are taken from your account and traded for you on the FX Markets by your bank in order to receive USD. Or for smaller banks they outsource this process to larger institutions. The USD is then sent to your supplier’s bank via a correspondent bank, which actually holds the USD. Chinese suppliers often hold offshore accounts, which means in order to pay their costs in China (raw materials, salaries, rent), this money needs to be sent to an onshore bank. Again a correspondent bank is often involved.

But the process doesn’t end there. The USD must be traded on the Chinese FX markets before RMB is finally available to the supplier. And when a wire arrives in China from abroad, the supplier must physically visit a bank branch to collect it. This involves a heap of paper work, stamps and signatures.

The whole process can easily take a week, and it won’t surprise anyone to learn that the banks don’t provide these services out of the kindness of their heart. Every step incurs a fee, most of which are hidden in FX exchange rates.

Q: What happens when the payee’s bank says no funds were received after the payer wired money? Is it common?

The simpler the process the less there is to go wrong. Unfortunately, as I’ve explained, the process is not simple at all! And remember – this is all using technology which was first developed in the 70s.

Payees claiming not to have received funds is not an uncommon problem. Unfortunately the system I’ve described has zero transparency – no one knows where a payment is at any given time. Which means that it can be hard to work out whether the supplier is stalling for more time, whether the payment is simply in transit, or whether there is a genuine problem which needs addressing. And every day the payment is delayed is another day production or shipment needs to wait. As time drags on and calls to the supplier simply confirm the money isn’t there yet, the only options you have are to keep waiting or initiate a wire trace.

So – there must be a website to do that right? Again, I’m afraid it isn’t that simple, as the SWIFT network is simply a messaging system. To “trace” a wire, your bank needs to send follow-ups to find out what happened to the initial message. And the only way to get them to do this? Get on the phone to your bank and ask for the Wire Transfer Department.

Whether it’s an issue with the banks’ systems failing to record the transfer between them, or the bank receiving the transfer being unable to accurately allocate it to your supplier’s account, this all takes time and effort to resolve. And the causes are many and varied – small typos, wrong recipient address, company name doesn’t fit within the character limit, the list goes on. If any of these things happen, the recipient bank will be unable to deposit the funds into the recipient account. Either the recipient information must be updated by the sending bank or the funds must be sent back…minus the processing fees.

Resolving these issues can take days – sometimes weeks. During this time products are delayed and the funds are locked up in the system. This can be killer for an importer’s cashflow and lead to some really angry customers.

Q: What is the cost of a typical bank wire to a Chinese supplier?

Buyers and suppliers tend to see bank charges as a cost of doing businesses. It has been built into their business models for years. But by not taking the time to look into alternative options and reduce these charges, they are leaving money on the table. Money that could go straight to their bottom line.

Goldman Sachs has estimated that banks are earning an average of 6% from their customers’ international payments. It’s difficult to estimate the cost of payments to China specifically – there’s not a typical transfer as I mentioned before – but of the businesses that we audit, payment fees can be anything between 3% and 10% across the entire transaction.

These fees are shared between both the importer and supplier, and both sides generally don’t recognise the other’s costs. But it’s important to understand that the total fees are built into the price. By reducing the costs for your supplier, you have leverage to reduce the cost on your invoice.

Paying suppliers in foreign currency also comes with less obvious costs. Our own discussions with suppliers and market research both seem to suggest that most suppliers add around 5% to the price of all non-RMB invoices, as a crude hedge against currency risk. Once you factor all of this in, paying in RMB with a low-fee payment method starts to make a big difference to your bottom-line.

When international trade is increasingly working on tight margins and a few % points makes the difference between winning and losing business, being smart about your payment costs can be a fast way to making your business significantly more competitive. Importers should first make themselves aware what they’re actually paying for their wire transfers, then explore the many solutions to reduce these costs.

Related reading: How to Pay Chinese Suppliers by T/T Payment (Bank Wire Transfer)