Unless you have been living under a rock, you have heard of Trump’s clear intentions to raise USA tariffs on products imported into America … with a particular focus on those coming from China.

Dan Harris clearly lays out the basic facts in Trump’s New Tariffs and Their Impact on U.S. Trade with China, Mexico, and Canada.

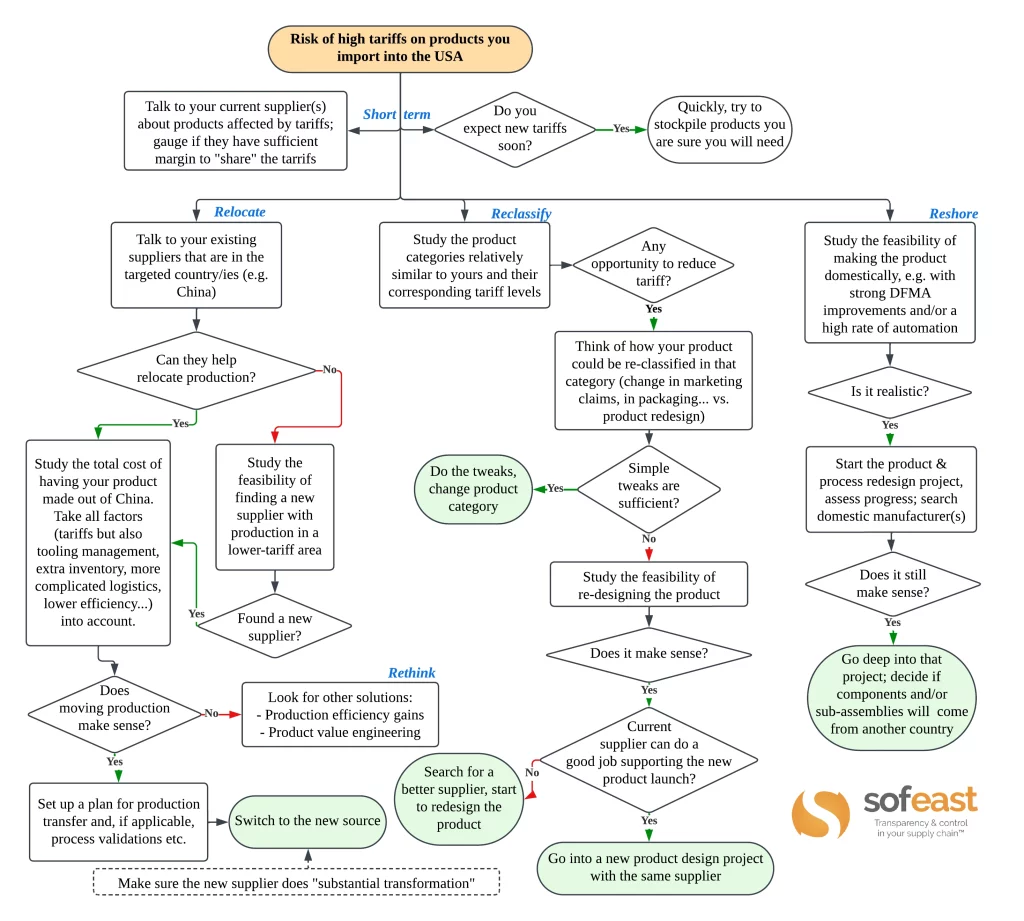

Now, how do we navigate those upcoming tariffs? Our customers have repeatedly asked us this question. Here is our answer.

6 things to consider to avoid or reduce the impact of USA tariffs if you’re at risk

There are basically six things you can look at to reduce the impact of or avoid USA tariffs.

Two things in the short term. And four in the longer term. I summarized it this way:

1. In the short term

First, study the opportunity of stockpiling some products now, before new USA tariffs come into place. That’s an approach many companies have followed over the past few weeks, and many Chinese suppliers are very busy as we are writing this article.

Obviously, make sure these are products you would really be able to sell. Otherwise, to avoid an extra charge of, say, 10 or 20%, you might be left with a lot of inventory that will be headed for the landfill.

Second, talk to your current suppliers. They are certainly aware of the situation. When the tariffs start to come, tell them that you can’t raise your prices to your own customers, and they need to shoulder their share of the tariff. In 2018, a lot of American companies managed to get their Chinese suppliers to reduce their prices so that the total landed cost of the product did not increase to the point where it would threaten the economic viability of importing them.

Now, this is only possible if your Chinese suppliers have a healthy margin. If they run on a few percent of margin, there is little they can give you, obviously. But if you distribute their product, they might make a 20% to 30% margin and they may be persuaded to drop their price by 5 or 10% without a big fight.

2. Longer term: Reclassify, Relocate, Reshore, or Rethink

Let’s look at what to do to get you prepared for the long term.

Basically, you may need to reclassify the product, relocate production to another low-cost country, reshore production so it takes place in the USA, and/or re-think the product design or the manufacturing process.

3. Reclassification products could be a useful option

Many companies should look into reclassification of the product.

Your product is classed in a certain way. Depending on its HS code, it may be subject to high tariffs which will cost you a lot of money. This may be due to a certain material the product uses, to certain marketing claims, or other factors. I am not a specialist, but international trade experts might point to a relatively similar class that is subject to lower tariffs or no tariffs. You might be able to make small adjustments and legally avoid USA tariffs.

If deeper adjustments to the product are needed that necessitate a full redesign, you need to study the feasibility of that action. Estimate the budget and the timelines.

Maybe the product was developed by the supplier, and they will not be able to help. Maybe you have lost the competencies, and you need to find a way to get a new team to work on the new design. Maybe your current team can handle it.

The next question is, can the current supplier do a good job supporting the redesign and launch of the new product? Maybe it is also an opportunity to improve your supply chain and work with a better supplier.

4. Relocation to another country

What are most companies thinking of? Relocation to another country – usually from China to Vietnam, Malaysia, Thailand, India, or Mexico.

The first step is usually to talk with your current suppliers. Maybe your Chinese supplier has set up a production facility in Vietnam, or they are cooperating with a production facility in Thailand, for example.

Can they accompany you and relocate production? If they can, you need to understand all the implications. What some of our customers have found is that, in many cases, production in China with 15% tariffs was still cheaper than production in, say, Vietnam! That’s not always true and it depends very much on the type of product.

Why such a higher cost base outside of China? This is due to the extra cost of buying certain local components and or running local manufacturing processes, as well as the extra cost of shipping, and the cost of carrying more inventory, among other factors.

If moving production still makes sense, you need to set up a plan for production transfer. It is not as simple as pressing a button. The product, if it is unique and has never been made in that new production facility, needs to go through the same process validation steps as the first time it was launched. And the process is heavier in regulated industries, for instance when it comes to medical devices.

What if your current supplier(s) cannot help you relocate production? You need to study the practicality and feasibility of moving production to a new supplier. You will need to identify and qualify that new supplier.

Oh, and what if you operate your own manufacturing facility and you need to move it to a new country? Setting up a new factory is a big project in itself, and I’d suggest you read MTG’s plant relocation guide.

5. Reshoring

Another type of relocation is ‘reshoring’ of manufacturing – in effect, bringing it to the USA.

I tend to show this option as a separate branch in the flowchart because it involves very different preparations than relocating to another relatively low-cost country.

Reshowing production does not mean the whole supply chain will be scrapped and everything will be sourced from the USA. That might not be realistic, and it might not even be possible.

The first step, again, is to study the feasibility of this move.

If a lot of assembly is to take place in a high-wage country, you might also need to redesign the product and follow the principles of DFMA (Design For Manufacturing & Assembly). This way, you might be able to reduce the time it takes to assemble the product by a factor of 2 to 5, and that might make the move economically possible.

In other cases, you might have to purchase subassemblies and components from your current supplier base and do the final assembly work in the USA. Let me suggest a few words of caution on this topic:

- Those components and he subassemblies might be affected by tariffs at some point.

- You might get in trouble with the US Customs and Border Protection Administration if you do not carry out what they consider ‘substantial transformation’ in the USA.

Another benefit of DFMA is that, if you redesign the product so that manual assembly is easier, it also makes automation easier.

This brings us to the sixth option you might consider…

6. Rethinking your product design or manufacturing processes

Once you rethink your product design and/or the manufacturing processes behind it, you might find an enormous potential for cost savings.

In many cases, the manufacturing operations are far from the optimal level of efficiency one could expect, and some consultants can help you evaluate the cost savings you can realize both in assembly and in the other manufacturing processes. (Unfortunately, that’s only if you have visibility over, and access to, your supply chain.)

Another type of improvement has to do with the product design. You can engage in what they call ‘value analysis’ and ‘value engineering’. For example, you might have noticed that the back of most IKEA cabinets is made of rather flimsy materials. That’s a way of cutting costs where customers don’t really mind. IKEA has shaved costs wherever it makes sense, and their customers are usually not complaining about it. Actually, their customers are happy because these costs savings have been passed along to them.

In summary

To summarize, there are some actions you can take in the short term to deal with the USA tariffs, but you may also have to make heavy decisions that you will have to commit to for the long term.

The right path for you depends on your business, of course. If you purchase a high-volume product that has a long expected lifetime, investing in redesigning it may make a lot of sense. Doing that on several various products that are purchased in relatively low volume might prove impossible.