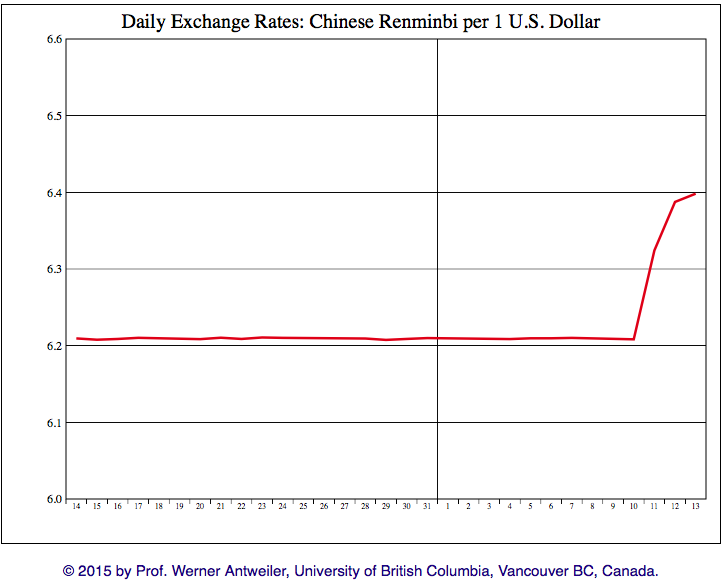

Over the past few days, China’s central bank has let the RMB slide by a few percentage points.

Over the past few days, China’s central bank has let the RMB slide by a few percentage points.

Is it big news? For importers who make a slim margin on what they purchase from China, obviously it is.

Is it big news? For importers who make a slim margin on what they purchase from China, obviously it is.

In the long run, this trend was expected, as I wrote here. Financial markets were anticipating this move — and now they are anticipating even stronger depreciation.

On the positive side, Chinese suppliers will have strong pressure to reduce their USD prices if this trend continues.

However, if your supplier purchases a high amount of imported goods, this devaluation will mean more expensive components, and overall their prices won’t decrease. Add to this the numerous excuses Chinese suppliers are ready to give you (wages are up. we underestimated the complexity of your production, our supplier insists on a price increase, etc.), and many importers will be given no rebate.

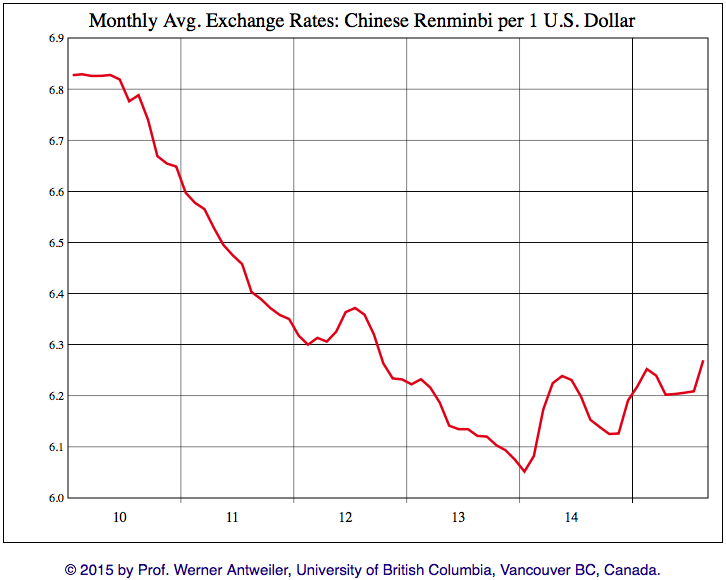

How low can the RMB get? If the export numbers don’t get better, if Beijing thinks it impacts the country’s growth and employment in a significant way, AND if the inflationary pressure remains moderate, a return to 6.8 or even 7.0 RMB per USD wouldn’t surprise me. The truth is, nobody knows.

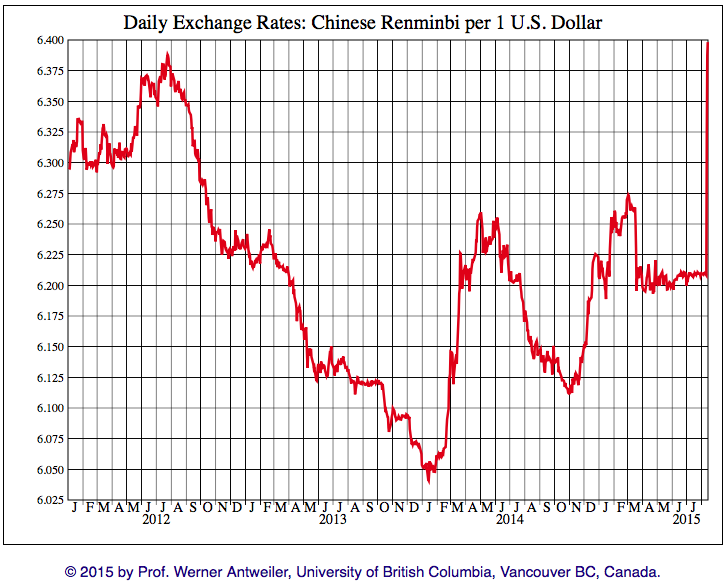

We are actually back to the situation of Mid-2012.

But, seen on a longer time period, this move isn’t really significant (yet?).

How to take full advantage of this trend? You can get quotes in RMB and settle what you purchase in RMB, as I explained here. A number of large companies are already doing this, and there is no reason midsize importers can’t do this.

Ultimate Guide To Sourcing From China And Developing Your Suppliers [eBook]

This FREE eBook starts from the beginning, discussing whether you need to hire a sourcing agent, and follows the sourcing process right through to developing a trusted supplier’s quality and productivity.

There are 15 chapters over 80+ pages to explore, providing exhaustive guidance on the entire sourcing and supplier development process from start to finish, including:

- Identifying suppliers,

- Negotiations,

- Quality inspections,

- Developing Chinese suppliers,

- Improving factory quality and productivity,

- and much more…

This seems focused on importers that import components that will then be made into products for export. How about an article on importers who sell finished products to wholesalers?

Harland: I guess you mean a company that imports products from China and sells them on its domestic market. The effect is just the same. The RMB devaluation means the quotes you will get starting today should be a bit lower than those you got one week ago, for the exact same product. And you are better off getting quotes in RMB and USD, and settling in RMB.

As we all know that RMB Devaluation will be useful for the export from China. At the same time that means China’s economic downturn is serious. So the goverment need to stimulate the export. But I think that’s not enough.