We started comparing the average wages across Asia in 2015 to help importers decide which country might be the best option for them to source from.

As I mentioned before, you need to consider the following data (among others):

- The trend of the average wages in the countries in question

- The stability of exchange rates, for example against the US dollar

Back in 2015, China’s increasing wages were followed by other neighboring countries. Its ‘real’ cost of skilled factory labor, which is much higher than the minimum wage (shown in our graphs below, as it is easy to track), was already higher than that of the other countries we compared it to.

By 2018, the difference had grown. It’s been quite clear for years that other Asian countries are better suited for making simpler and lower-cost products, such as basic footwear and clothing.

But now we’re in 2021, so what’s changed? Not very much, if one only looks at these data.

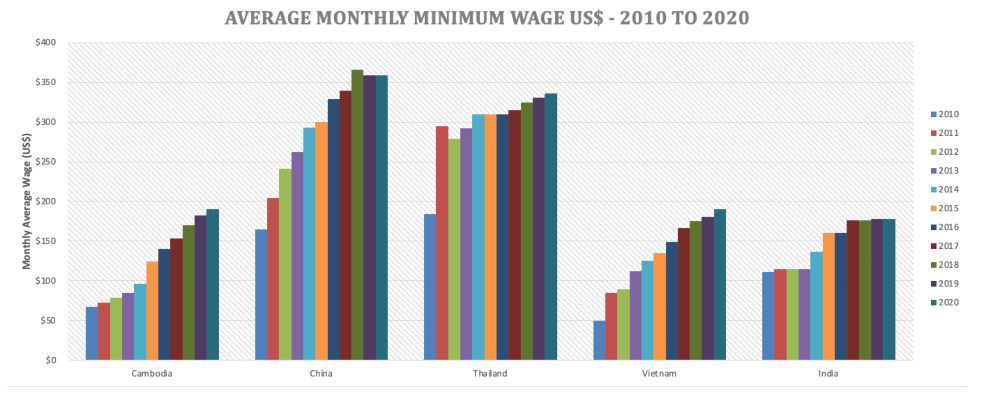

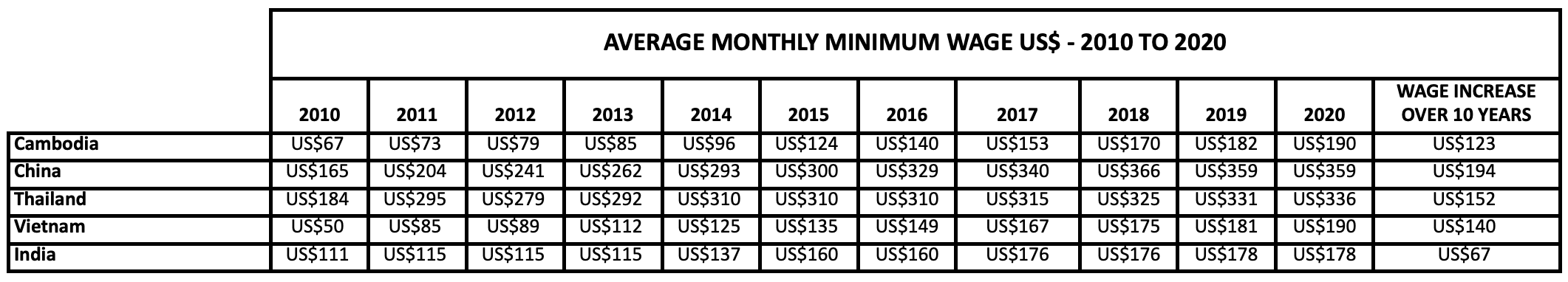

Monthly minimum wages

Let’s look at the average minimum wage changes for some of the key manufacturing countries in Asia (we’ve now included India, as this is a country of interest when we compare it to China, Vietnam, etc):

It’s clear to see that India, Cambodia, and Vietnam are more likely to provide ‘cheaper’ manufacturing than more expensive neighbors China and Thailand, although their wages have tended to plateau in recent years whereas we see them growing in Cambodia and Vietnam more rapidly.

Note that, although China’s wages are almost certainly higher than those of, say, India, in many manufacturing niches, China provides infrastructure, expertise, and sometimes productivity well in advance of its cheaper neighbors.

The source of these data is https://tradingeconomics.com/china/minimum-wages. That’s a very imperfect source of data, by the way, especially for China where every city sets a different minimum wage. In Dongguan, for example, the minimum wage has kept increasing, and the real cost of trained factory operators is much higher.

Let’s look at another interesting factor to take into consideration.

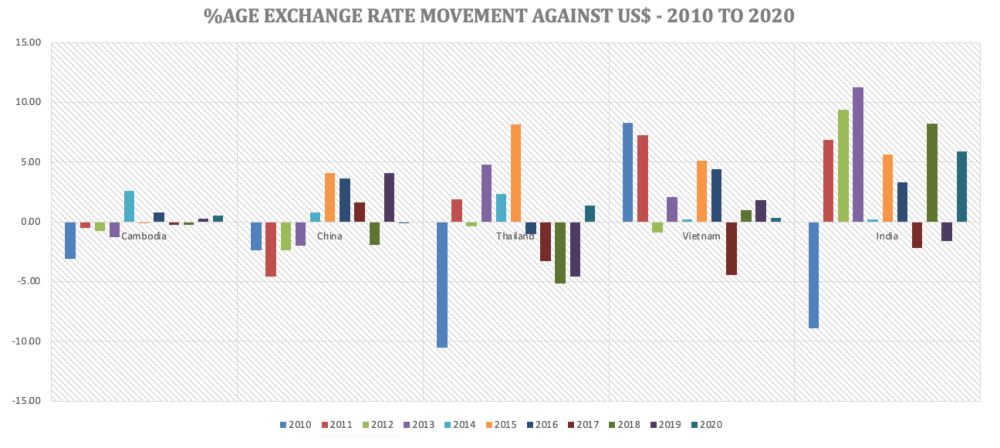

Currency variation against the US Dollar

A fluctuating currency against the USD is a source of high risk. It could have a negative effect on your business as it is harder to estimate costs and pin suppliers down to set pricing.

China and Cambodia have offered relatively stable exchange rates against the USD, whereas the other countries have swung more wildly, which can cause a headache for importers.

Conclusion

This data helps us to get an overview of these Asian countries’ competitiveness in terms of cost to buyers. It is no shock to see that China’s average wages are higher than those of Cambodia, for example, and it looks like Vietnam, Cambodia, and India will still remain competitive on cost for some years even though they are mainly seeing an upward trend in wages themselves.

However, high costs don’t necessarily remove China from the reckoning as your manufacturing base as we wrote about here:

China can be hard to beat for all but the lowest cost and most basic items. In many cases, the decision hinges on the following factors:

- China’s pros: many component suppliers are in-country; Chinese suppliers make it ‘easy’ to start making a product.

- China’s cons: high political risk for ‘Made in China and Sold in USA/Australia’ products; IP theft risks.

*******

What’s your take? Tell me by leaving a comment, please.

*IP theft risks.*

If you have an IP to protect, it would be a good idea to make it in China.

They copy everything in lightning speed and overtake you without spending much on basic research.

Sorry, I meant, it would not be a good idea…

Hi Cherry,

The reality is complicated. Even products that are made outside of China get copied pretty fast if they are successful on the market.

I wrote about this in https://www.sofeast.com/resources/ip-protection-in-china-developing-new-products-guide