A T/T payment is a common way to pay Chinese suppliers, but what is this payment type, how to make one, and what FAQs do importers have about the process? In addition, when you’re ready to pay a supplier, what kinds of payment terms might you negotiate with them?

Follow this link to download these slides for yourself.

What is a T/T payment?

T/T payment stands for ‘Telegraphic Transfer.’ In other words, an international wire of funds from the buyer’s bank to the seller’s bank.

When a Chinese supplier asks for a T/T payment, what they really mean is they want a wire transfer. (Technically, a T/T payment is not exactly the same as a wire transfer through the SWIFT system, but the vast majority of people think of them as the same thing.)

A wire transfer based on SWIFT is the most common payment method in international trade with Asian countries. It typically takes 3-5 working days to clear, and generally costs between 25 and 50 USD, depending on your agreement with the commercial department in your bank.

How to make a T/T payment to China?

Contact the commercial department of your bank, tell them you need to wire (for example) 25,000 USD to a company in China, and they will generally give you a form to fill out. If you do T/T payments frequently, your bank probably has an ‘internet banking’ application that will save you time.

Your supplier will probably send you a pro forma invoice that includes their bank account information. I strongly suggest you ask for that information earlier (as part of your pre-qualification of a potential supplier). Many buyers have been scammed by hackers who send invoices with their own bank account information…

I shot a short video that shows how to fill out a T/T payment application form:

After you have done this, take a screenshot, or get a digital copy, and send it to your supplier.

Important tips:

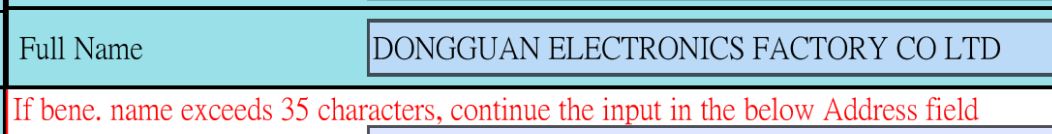

- Make sure to avoid any misspelling, which might cause the payment instruction to be held in limbo for weeks!

- You will need to write the company name in English, not in Chinese. Don’t try to do your own translation job, even if your written Chinese is excellent! It has to match exactly the English name that is registered in the seller’s bank records.

- If the company name is too long, keep writing it in the “address 1” field. This is sometimes mentioned on the T/T payment forms of banks that work a lot with China:

What is the most common payment term requested by Chinese suppliers?

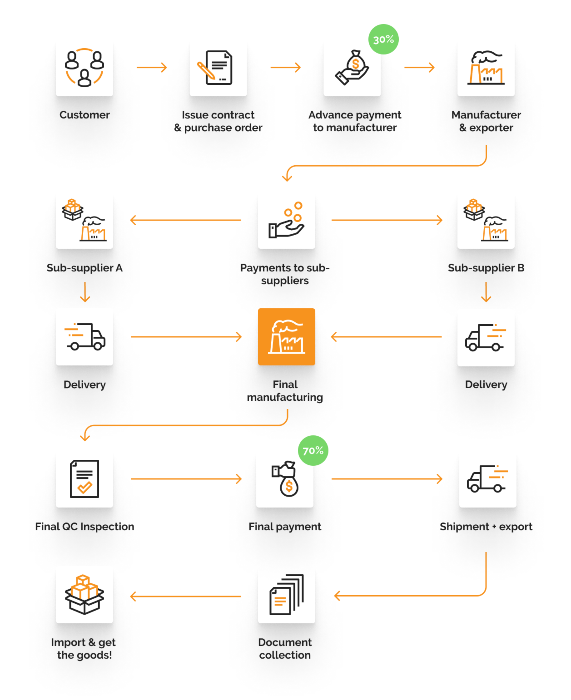

The most common payment method is a bank wire that works this way:

- You have the supplier develop sample(s) until you are confident they know exactly what you want.

- You send a 30% deposit (by T/T payment) before production starts.

- Your supplier (the manufacturer & exporter) purchases the components and/or materials and arranges the production

- You work with a quality assurance firm to inspect product quality (this is optional but usually a good idea).

- You send the remaining 70% (by T/T payment) before shipment.

- The supplier ships the goods and sends you the documents by express courier.

In graphical form, it looks like this:

What is another common, and better, payment term for paying your Chinese supplier?

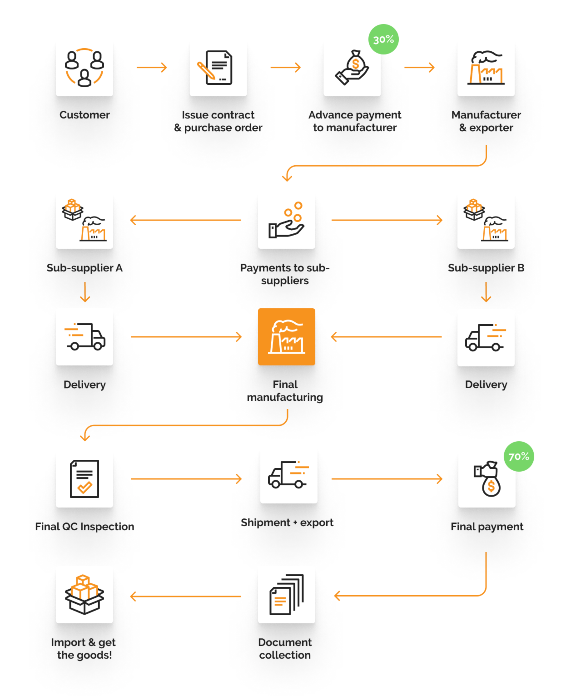

It is quite similar, except for the end of the process.

- Once the supplier confirms the goods are ready, send an inspector to check quality (again, not a must, but highly advised)

- If quality is OK, release the goods (allow the goods to be shipped out) — this works best if you purchased under FOB terms

- Once the goods are on the ship, the supplier gets the Bill of Lading (B/L), and sends you a copy of it

- If the product name, quantity, etc. are all fine on the bill of lading, you send the final payment to the supplier

- Once the supplier receives the payment, they send you the original B/L

It looks like this:

Why is this payment term a better choice for importers from China?

- The buyer knows the goods have been shipped out before paying the remainder.

- The supplier knows the buyer can only take possession of the goods after the original bill of lading has been sent.

Can you negotiate this term? If you insist on it from the very start, and if your suppliers are motivated to work with you, probably yes. If you come out as a beginner and your orders are very small, probably not.

How to negotiate better payment terms from a supplier in China?

There are various ways you might be able to negotiate for payment of some (or all) of the amount after shipment.

- Your company is well established and famous — think Apple or Disney. The risk of the buyer’s company defaulting is much lower. You can work work with relatively large manufacturers, who have facilities to finance their working capital easily. And the seller wants to boast about that prestigious customer in order to get more business, so they usually want to make an effort.

- You have a buying office in China — having a strong presence in-country does help. A supplier that hasn’t been paid in time can visit you and take different measures to push you for faster payment (especially if your China office signs contracts with them), so they feel there are at lower risk. From our experience, when we help our clients by paying their suppliers, we can often negotiate 0% deposit and 100% after shipment, at end of month with the suppliers after a few shipments (negotiating this from the start is not realistic, though).

How to get help from a financial institution?

There are two ways financial institutions (some banks, but also certain fintech startups) can help you:

- You can arrange financing of your suppliers — as the buyer, if you have a healthy balance sheet and you purchase regularly from a certain supplier, you can work with a financial institution that will advance a good chunk of the money to your supplier, while you can pay later (in some cases, 90 days after shipment!) This used to be only possible for large companies, but recently I heard of options for smaller companies.

- You can borrow money for a certain time period, to finance your orders. This type of loan is often granted by the same financial institutions I mentioned in the previous point.

Contact me if you need more information about making a T/T payment. We don’t provide this service, but we can probably point you in the right direction.

Frequently Asked Questions for making a T/T payment to China

Tips and tricks about the T/T payment process

What are some mistakes we should never make?

Here are two big no-nos:

- You should never pre-pay 100% of the order before production starts. We have seen buyers make this mistake and deeply regret it. Once that’s done, what keeps the factory working hard on shipping good products to you on time? You will become their last priority…

- You should never wire the down payment before having a relatively high certainty that the factory knows what you expect of them. Most experienced buyers issue purchase orders, then receive a sample and confirm it is very close to what they want to receive (after mass production), and after that, they send the advance payment. In some cases, you might need

The supplier says they need a deposit earlier to buy one of the components, which needs to be ordered 3 months in advance. Is it true?

It might be true. Yes, it does happen. If possible, get all the information about that supplier, their product price, and so on.

In that case, you can usually negotiate the amount to pay at the time of that purchase. It is not necessarily 100%, but often is. And make sure you understand how much you will still need to pay later for the advance payment (before production).

What to do when an Alibaba supplier asks for payment by TT?

Should we issue a purchase order? It is considered as a contract?

At the very minimum, your supplier will send you their pro forma invoice and ask you to confirm it. Naturally, it comes with their own terms, which is why we suggest you issue your own purchase orders (POs).

However, a PO is not a contract. It is difficult to sue a rogue Chinese supplier on the basis of a PO. A purchase agreement, or manufacturing agreement, is what you need (and make sure it is enforceable in China).

Should we pay suppliers in USD or in RMB (China’s currency)?

My bank tells me sending money in CNY (RMB) to a supplier in China is cheaper than sending it in USD. Do YOU advise doing that?

So, we suggest you ask a bank officer to confirm this is something they are used to facilitating and it will work out fine.

And you will also need to make sure the supplier gave you a bank account that accepts CNY received from an international source, of course.

Note: more and more companies pay their suppliers in CNY regularly. It is part of a wider system. Quotations are in CNY, payments are in CNY, etc. I wrote about it here.

Do you advise using the FOB incoterm, when the shipment is by sea?

If you purchase products from a Chinese company, do like most other buyers — buy under the FOB (“Freight On Board”) incoterm. It means you appoint the freight forwarder (or directly the shipping line) that will handle international transport.

As we suggested above, you don’t want the supplier to ship the goods before a final quality inspection has taken place. If you buy FOB, the shipment can only take place after your freight forwarder has released the “shipping order” to your supplier.

You can find more information on this topic in this post about negotiation.

When should the “deposit” (or “advance payment”) be sent to the supplier?

In general, a deposit is wired as a T/T payment (or an L/C is opened) only after samples have been approved.

If the supplier asks for an early payment to do a “feasibility study” or “prototyping work”, that might make sense. But keep it separate from the deposit, and have the supplier commit to an agreed deliverable.

Our bank charges us a lot for an international wire. Is there a cheaper alternative?

If your bank charges you 40 USD or more, and their transfers take 4-5 working days to be executed, you are working with a traditional bank that follows an antiquated system (SWIFT was developed in the 1970s). This should change in the coming years with cryptocurrencies such as XRP, but right now there are other solutions.

Some of our clients have used alternative solutions and seem happy about these services. Depending on your situation, they might offer a better deal than your traditional bank. Here are a few examples:

# If you make payments from your country

- Wise.com — was set up to compete directly with traditional banks when it comes to T/T payments. Has become quite popular. In early 2020, they added the ability to send money to an Alipay account (but I strongly advise against payments to personal accounts).

- Payoneer — very convenient for collecting money from marketplaces such as Amazon. Sending money to another company that has its own Payoneer account is fast and inexpensive.

- Revolut — seems to be geared more to European consumers and companies, so far. Fantastic value for certain usage.

# If you can make payments from Hong Kong

The above options are still valid, but in addition:

- If your Chinese suppliers accept payment in Hong Kong, you may set up a business account there and do local transfers (immediate and inexpensive). Companies like Rapyd can help if you want to set this up (for 99 USD a month, so that’s viable only if you have a lot of payments to send).

[Note: We are NOT getting any affiliate fees or commissions of any kind from the companies listed on this page.]

What about payments to service providers?

If the amount is small, Paypal is most often used.

For amounts above 300-400 USD, bank wires (T/T) start to make more sense.

Can a bank wire transfer get “lost” in the system?

I never heard of a transaction that got lost forever (i.e. never arrived, even after honest investigations), but I heard of many transactions that “disappeared” for a little while. The whole SWIFT system is a bit clunky. It would happen as follows:

- Payer’s bank processes the application for payment

- Payee’s bank doesn’t register the money coming in

- Payee asks his own bank to investigate, and no information is found

- Payee asks the payer to ask their own bank to investigate, and they find an issue that was holding the execution of the wire

Depending on the two banks’ reactivity, unlocking such a situation can take up to 2 months!

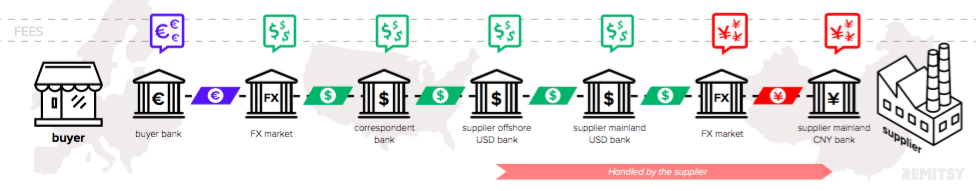

Why is this process (SWIFT) so inefficient?

SWIFT was originally built in 1973 – long before the creation of the Internet. When money is sent overseas, physical assets don’t have to move. Instead, SWIFT acts as a messaging system between banks to clarify the ownership of assets on their books.

Euros are taken from your account and traded for you on the FX Markets by your bank in order to receive USD. Or for smaller banks, they outsource this process to larger institutions. The USD is then sent to your supplier’s bank via a correspondent bank, which actually holds the USD. Chinese suppliers often hold offshore accounts, which means in order to pay their costs in China (raw materials, salaries, rent), this money needs to be sent to an onshore bank. Again a correspondent bank is often involved.But the process doesn’t end there. The USD must be traded on the Chinese FX markets before RMB is finally available to the supplier. And when a wire arrives in China from abroad, the supplier must physically visit a bank branch to collect it. This involves a heap of paperwork, stamps and signatures.

Is it risky to send a T/T payment to China?

There are cases where the payer says “I sent this to you 3 weeks ago” and the payee says “I don’t see it on my bank statement”, sure. Both parties contact their relative banks with the unique transaction number, and especially the payer asks their bank to launch a tracing procedure, and eventually it tends to work out fine. As long as both parties are not playing games.Nearly all the risk lies in picking the wrong company, or people, as counter parties to the transaction. Make sure you do proper due diligence. Once you have sent a T/T payment, there is no way to call it back.

Frequent issues

Are there common scams that we should be aware of?

The supplier says they got a smaller amount than we wired. How is it possible?

It often happens. Here are the typical steps behind this, for a hypothetical 5,000 USD amount:

- Payer’s bank receives instruction to do a wire for $5,000 and charges a $ 25 fee. Payer is down $5,025.

- Payer’s bank chooses to work with an intermediary bank that has a direct ‘channel’ to send the money to the payee’s bank. That intermediary charges $25.

- Payee’s bank receives $4,975, and payee’s bank charges $10, which means in the end payee receives $4,965.

- The total cost of the payment (to both parties) is $60, which is 1.2% of $5,000.

(Note that the $25 fees typically range from $20 to $40, but there are no absolute rules here. Ask your bank’s commercial department in advance.)

Our supplier asks for payments to be wired on a personal account. Is it a problem?

Ask for an invoice that calls for payment to their company account. If you send money to a personal account, it will be much more difficult to litigate against them if they let you down later.

If they insist on payment to a personal account, there might be several reasons:

- The amount of the purchase is very low (for example, 1000 USD), and it makes no sense for them to do all the paperwork for converting your USD into RMB and so on and so forth.

- They don’t want to declare it in order to avoid taxes. This is not reassuring, but it is still very common in China. Don’t expect this company to be a perfect supplier over time.

Our supplier asks for payments to be sent to a different company. Is it a problem?

Not necessarily. Again, there might be several reasons. They might use a Hong Kong company to avoid declaring the sale in China (and pay taxes), they might not have an export licence, and/or they might find it much more convenient to collect payments and do all the export procedures under another company.

As I wrote above, this will make it harder for you to litigate against your supplier, since you won’t be able to show a trail of payments from your company to theirs.

What can you do? The very minimum is for you to ask both companies (your supplier — “A”, and the one collecting payments — “B”) to jointly sign and stamp on a declaration that B is collecting payments on behalf of A and that A is the supplier to your company.

About negotiations

Why do suppliers in China, Vietnam, or India always want payment before we get our products?

For three reasons:

- They know that it is a “standard” and they suspect that you, as the buyer, will have a hard time finding a better deal.

- They need cash to pay their suppliers who, for a good part, don’t extend any credit.

- They have heard many stories of buyers who played games and managed to underpay for their production, or even cancelled after production was completed without having paid anything — for good reasons (poor quality) or bad reasons (disappointing sales, low cash position, etc.)

Can the amount of the deposit (before production) be negotiated down?

If the supplier sees your project as interesting in the mid- to long-term, and if the manufacturer has sufficient cash on hand to order and pay the components, yes it is generally negotiable.

If your production is highly customized and (in the unfortunate event of order cancellation) difficult to sell to another customer, negotiating a lower deposit will be difficult. It is a measure of risk prevention.

Do all component suppliers need payment in advance?

It depends on the industry, on the business relationship, on their power on the market, and so on:

- Some always do.

- Some do if they don’t have any confidence, but extend credit (generally 10-30 days, or enough time for the assembler to complete production and ship the goods out) when they feel the risk is limited.

Our supplier asks us to pay all the remaining 70% before they ship the goods. Is it dangerous?

Can we negotiate for 100% to be paid after we receive the goods?

I have heard of companies in the US or in Europe who have managed to negotiate that type of deal. Here is their situation:

- They buy relatively high volumes and are not very tough on pricing (in other words, they are attractive to suppliers)

- They buy standard products for which there is high competition

- They ask 50 to 200 potential suppliers if they’d be open to that type of deal; they keep talking to the 5% who say they might be interested; they do business with 1 or 2 of them

*Editor’s note: This post was originally published in 2012, and has since been updated to include new information and formatting.

Need help setting the right terms with your suppliers or have any questions about T/T payments?

Do you have any questions about making t/t payments to overseas suppliers that we haven’t addressed here? Any experiences to share with the community? Questions about payment terms? Let us know in the comments below or contact us!

I am learning about another alternative called “Escrow” payments, such as what Alibaba.com offers. I have not used it but my research suggests that it is an option that is more secure than T/T and less expensive than L/C. The drawback is that both buyer and seller must sign up with Alibaba.com. Any comments on them?

I am an online seller and use alibaba for some supplies. The escrow method they use is the seller doesn’t get your money until you receive the goods and release it (on Aliexpress anyways). They operate on a feedback system much as ebay and has a buyer protection clause that so far has worked ok for me but is not foolproof. The sellers have no incentive to not send your goods. Do not make the mistake I made and pay by Western Union ever. My small company lost $500 from a Chines sham company with a fake pretty website that doesn’t ship anything.

I agree that Aliexpress’ system is a vast improvement over Western Union payments.

Please POST the scam website!!!

Who was it???

Carl,

Escrow payments might be fine for small amounts, and if you don’t have duties to pay.

Be aware of the risks, though… I advise you to read https://www.qualityinspection.org/alibaba-fraud (the article, and also the comments).

I want to export iron-ore on fob basis with t/t payment mode, no advance being paid by buyer, how to make the deal secure so that buyers carrier (vessel) will not be able to leave port

If you don’t want the goods to “leave port” before you get paid 100%, then you need to collect 100% of the payment before you bring the goods to the port.

HI THERE.. IM IN THE PROCESS TO BUY TIRES FROM CHINA HOW CAN I VERIFY THE COMPANY AND THE BACKROUND? AND HOW CAN I FIND A COMPANY TO INSPECT MY TIRES BEFORE THE SHIPPED?

I sent you an email.

Hello Sir, please i need your advice , i am ordering a goods from China and they are dealing with TT payment method, how can i make sure to secure the shipment because i deal only with LC payment method, and if you know inspector company to deal with to inspect the goods before shipping.

Thank you

Hello Ruba, we can help you do 2 things:

– Check if the supplier’s company is legitimate and their factory has a quality system, before you wire the initial payment (usually 30%)

– Check the quality of the products before you wire the balance (usually 70%)

You can see these services on https://www.sofeast.com

Hi

This is a bit off the topic but I want to find out if a chinese supplier is legit. how do I go about doing that?

I am going to contact you.

Renaud Anjoran

Can you contact me with these details also? Thank you in advance.

If the supplier says they are a manufacturer, my company can audit their factory — contact me at ra[at]sofeast.com.

If the supplier says they are an agent but they will sell the goods themselves to you, you can use the services at https://www.chinacheckup.com.

If you need to check the products before shipment, again my company can help and you should contact me.

I too want to find out if a chinese supplier is legit. how do I go about doing that?

the company name is Guangzhou Lifeng Printing Co., Ltd.

[ Guangdong, China (Mainland) ] I would be grateful if you could give me any help ASAP

before committing to acing an order

thank you

You can do this at https://www.chinacheckup.com in an economical way. Or we can audit the factory (if they are the manufacturer, and not a trading company) and tell you what they make, how organized they are, what processes they have in house, etc.

Hi , we are planning to start the registered office in xiamen for selling the raw granite blocks , your concern support for the same .

I to would like to know the answer to that question. I know I could fly over and check but that seems a bit much.

Heath, please see above.

Hi,

Could you please share the info with me as well? I am in the process of buying some goods from China using Alibaba and I have no clue how to do the background check.

Thank you.

Monika, please see above.

Why can’t you try ” escrow payment “

I would like to no if this company am dealing with really exist shuntong group Co limited. is JUN ZUO . B.D manager of no. +86-159-64983783 really work for this company.

Shortly we will receive a Irrevocable and Trasfferable Letterof Credit with US$ through US Bank.. We will give an insturaction to US Bank to transffer this LC to the Bank in China ider his bank or supplier bank I don’t know right now.

L/C is baised CIF we will cover Insurance and Fright charges. Chinese Manufacturer is insisting TT payment which we can not do Bank which has the L/C and they are authorise to effect the payment upon they receive Shipping Invoice and Ball of Lading these paper works are approving that shipment was effected with complete detailes like ordered materials,the way of packing ,size of packing as well as weight of total amount goods and 100% amount of counter value goods ready to be paid . Why this is difficult for Chinese Factories.We can not pay any other way. Our way of payment are most secure way protecting both sides interest.

Oh, so you a customer will open an L/C to pay you, and you want to transfer the L/C to your supplier in China, but that supplier insists on T/T payment. That’s classic, and as I wrote in https://qualityinspection.org/china-supplier-lc there may be a way forward…

In the worst case, maybe you pay 30% by T/T and the rest by L/C?