Our marketing assistant Maria has done research on the Vietnam manufacturing sector: the top export industries, the trends, the labor costs, and logistics.

Here is her article.

Textile and Clothing – top sector no more?

Out of all Vietnam manufacturing sectors, the most known would probably be the textile industry. Due to extremely competitive wage policies, one of the lowest in the region, textile and clothing has become the largest contributor to Vietnam’s exports. Thanks to the bilateral agreement with the US in 2000 coupled with WTO membership in 2007, the country’s textile industry now comes second to China as the top clothing and footwear supplier of the USA. The most recent data of the US Office of Textiles and Apparel (OTEXA) records textile imports from Vietnam as having 8.38% share of the whole US market, still a far cry but continuously catching up with China’s 47.97%.

The Ho Chi Minh City Association of Garments, Textiles, Embroidery and Knitting (Agtek) and the Vietnam Textile and Apparel Association (Vitas) credit the country’s production power to the more than 2,000 garment and textile enterprises scattered all over the nation, composed of “50 state-owned enterprises (SOEs), 1,400 private enterprises and 450 foreign direct investment (FDI) enterprises”. 200 of these are foreign-invested and are based in Ho Chi Minh.

We can only predict that the numbers have no way to go but up. Recently, Vinatex and petroleum magnate PetroVietnam built a $200 million plant in the port city of northern Haiphong. The plant has the capacity to produce about half of the demand for domestic yarn through synthetic fibre processing.

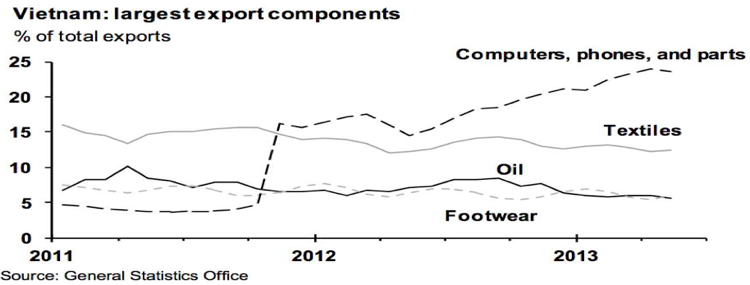

Electronics – the unexpected rising tiger

Electronics has successfully inched its way to the top. This electronics sector now leads the country’s total exports, effectively overtaking the textile industry as Vietnam’s largest export. Foreign manufacturers continue to flow in due to Vietnam’s lower costs and wages as compared to China’s alternatives. Samsung Electronics Co and Nokia Oyj are just some of the major electronics manufacturers which availed of this booming sector. Samsung, for one, is building a $2 billion plant with a capacity to make 120 million handsets annually up to 2015. According to Vietnam’s General Statistics Office, the electronics sector drove Vietnam’s exports to grow by 15.4 percent between the years 2012 to 2013. Electronics production zones have been set up in Ho Chi Minh and Hai Pong.

Other key manufacturing industries

Aside from textile and electronics, other manufacturing sectors have been identified as key industries: “motor vehicles, shipbuilding, food processing, steel, petrochemicals, and software” (According to a proposal by Vietnam’s Central Institute for Economic Management). There are also support industries such as “engine manufacturing, flat steel products, agricultural products and raw materials including crude oil, composite plastics, artificial rubber, aluminum and synthetic fibers.”

These manufacturing industries are mostly (up to a third of the total number) located in Ho Chi Minh. The city has a total of 16 zones focused on industrial, export-processing and high technology manufacturing. Zones outside HCM namely Vietnam-Singapore Industrial Parks I & II in Binh Duong and Amata Industrial Park in Dong Nai are also havens for manufacturing.

Minimum salary and the four wage regions

Vietnam devised a wage system that mandates different wage levels for the four regions according to their respective socio-economic development levels. “Region One covers urban Ha Noi and HCM City. Zone Two covers rural Ha Noi and HCM City plus urban Can Tho, Da Nang, and Hai Phong. Zone Three covers provincial cities and the districts of Bac Ninh, Bac Giang, Hai Duong, and Vinh Phuc. Zone Four covers the remaining localities.”

Starting January 1, 2014, the average monthly wage amounts to VND 2.7 million (USD 128), an increase from 2013’s VND 1.9 million (USD 89.3).

Ports – left behind but now catching up

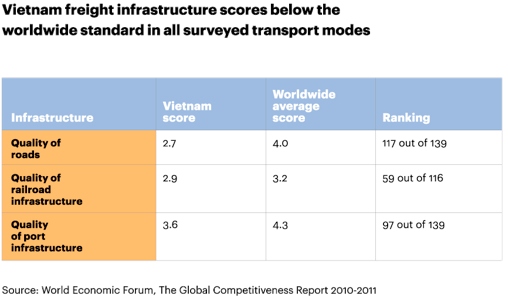

Logistical infrastructures are not Vietnam’s strong point:

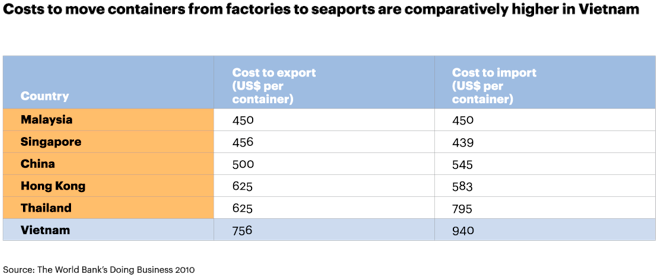

As a consequence, internal freight costs are relatively high:

Despite government efforts, Vietnam’s ports still leave a lot to be desired. It has 114 seaports, 14 of which are named as major ports. The new Saigon port complex aims to fill the gaps by conveniently situating itself among the industrial parks and export processing zones of Ho Chi Minh, Binh Duong, Dong Nai and Ba Ria – Vung Tau. The new port in Dung Quat and Quang Ninh aims to supplement Saigon’s capacity as well.

Photo credit: http://www.flickr.com/photos/iloasiapacific/10987405545/

Sofeast: Quality Assurance In China Or Vietnam For Beginners [eBook]

This free eBook shows importers who are new to outsourcing production to China or Vietnam the five key foundations of a proven Quality Assurance strategy, and also shows you some common traps that importers fall into and how to avoid or overcome them in order to get the best possible production results.

Ready to get your copy? Hit the button below:

“Aside from textile and electronics, other manufacturing sectors have been identified as key industries: “motor vehicles, shipbuilding, food processing, steel, petrochemicals, and software” (According to a proposal by Vietnam’s Central Institute for Economic Management). There are also support industries such as “engine manufacturing, flat steel products, agricultural products and raw materials including crude oil, composite plastics, artificial rubber, aluminum and synthetic fibers.”

What about furniture manufacturing in Vietnam as compared with China? I thought that would be considered a key industry as well?

Apparently not by that institute, which probably tried to focus on more value-adding sectors.

But you are right, furniture manufacturing is not a negligible industry in Vietnam.