This is the second in the series of articles helping you through the New Product Development process. Phase 1 (idea generation) was described here.

This is the second in the series of articles helping you through the New Product Development process. Phase 1 (idea generation) was described here.

(Don’t forget that you can see the whole series on developing a new product here).

Here we will be focusing on the next process step, phase 2:

The goal is to identify one or two solid potential ideas that can move into Phase 3 and eventually made in China and sold in your target market.

Idea Screening

Once all the viable ideas are listed, they have to be further developed, evaluated, prioritized, and analyzed so that one or two ideas can be selected for further development into a product concept.

The next step involves screening all these ideas in order to select good ideas and drop poor ones as soon as possible. Product development costs rise dramatically the further into the process you get, so you want to make sure no bad idea gets too far in development.

There is a risk involved with the screening process, which is dropping the wrong idea which could turn into the ‘next big thing’. That said, it is always good practice to keep all the ideas recorded and filed for later use and analysis. And idea might have been dropped because the timing was just not right but may be perfect later on.

Interested in this topic? You may also like Sofeast’s New Product Launch Roadmap [XLS + Video]

Our ‘new product launch roadmap’ unveils the steps that your supplier will never tell you are needed, but yet all veteran buyers consider as indispensable. Hit the button to get your copy:

Screening Techniques

Decision Matrix

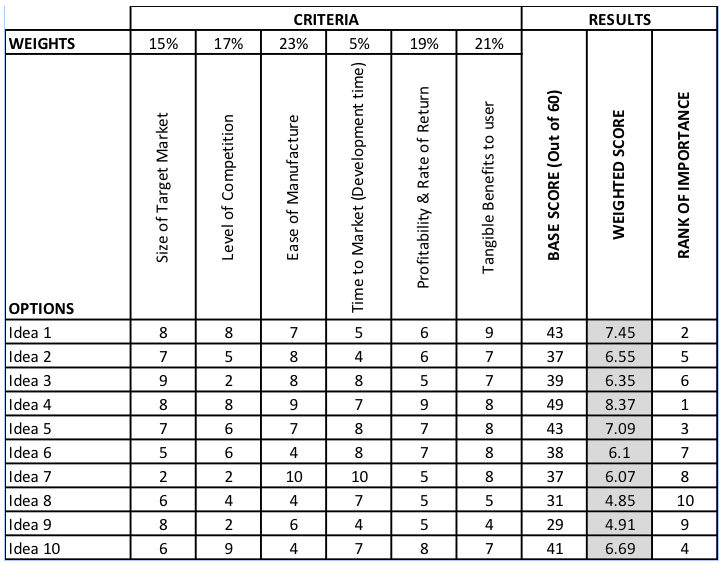

To ensure all new product ideas generated are screened against a level of objective measurement, a structured concept selection of screening and scoring should be adopted. A useful way of doing this is by setting up a matrix table. Below is an example of how this can be implemented, with the list of ideas being rated against key metrics that are weighted to allow for a feasibility score to be generated which can be ranked.

Ratings for the decision matrix can be ranked on a scale of 1 to 10, with ratings as follows:

- Size of Target Market: 1 (Smallest Size) – 10 (Largest Size)

- Level of Competition: 1 (Highest Level) – 10 (Lowest Level)

- Ease of Manufacture: 1 (Lowest Feasibility) – 10 (Highest Feasibility)

- Time to Market (Development Time): 1 (Longest Time) – 10 (Fastest Time)

- Profitability & Rate of Return: 1 (Lowest Profit) – 10 (Highest Profit)

- Tangible Benefits to User: 1 (Least Benefits) – 10 (Most Benefits)

Here is an example that you can download here (source: Velaction 2012):

For example, idea 1 and idea 5 both have a base score of 43, but idea 1 is more feasible than idea 5 so idea 1 gets the higher score.

Other techniques available

We have listed other interesting techniques below (source: Idea evaluation methods and techniques by Prof. Dr Miroslav Rebernik). You can learn more by searching them on the internet.

ANONYMOUS VOTING: It is based on the anonymity of participants’ choices. This is a group technique and is ideal for selecting from many initial ideas.

COST-BENEFIT ANALYSIS: It is a widely used and relatively simple tool for deciding whether to make a change or not. The quality of the decision depends on the depth of analysis of benefits and costs connected with the idea.

DECISION TREES: It is a decision support tool that uses a graph or model of decisions and their possible consequences, including chance event outcomes, resource costs, and utility. It is often appropriate for complex problems solving.

FORCE FIELD ANALYSIS: It is a group technique, and is very useful for checking the feasibility of idea implementation. It is simple to use. Its weakness is that it is subjective and opinion based. Force field analysis is a handy technique for looking at all the forces for and against a decision.

KANO MODEL ANALYSIS: It is the analysis of customers’ preferences. As such it is very focused and appropriate in the product development phase. However, it could be also be used in identifying customer needs, determining functional requirements, concept development and analysing competitive products. It is not useful for general idea selection.

NAF ANALYSIS – Novelty, Attractiveness, and Feasibility Analysis: This method is a quick and easy way of assessing new ideas for three issues: novelty, appeal and practicality. The method is especially appropriate before further development of an idea. The method is applicable individually or in a group and in many different areas. As it is simple to use, is appropriate for early phases in idea selection process. Its main contribution is to rank ideas.

Go / No-Go

The outcome from this phase is to get one or two ideas that can be progressed in the next stage, but before moving onto the next stage you should answer the question, can this product or project physically move into the next phase?

Go to part 3: The Stage ‘Gate’ Review Meeting in the NPD Process

Want to learn more about the new product introduction process for hardware startups?

Sofeast’s guide covers everything hardware startups need to know for making a new product in China and successfully bringing it to market.

Hit the button below to read the guide: