When I offered a model for guiding buyers to choose an ODM vs. OEM vs. CM supplier, I mentioned that OEM suppliers often “subsidize” the cost of developing the new product. Then, the buyer ends up paying the cost of development, but it is “amortized” in the unit cost of the product.

I’d like to explain why, in the context of when manufacturing a new product, that can be dangerous for the buyer.

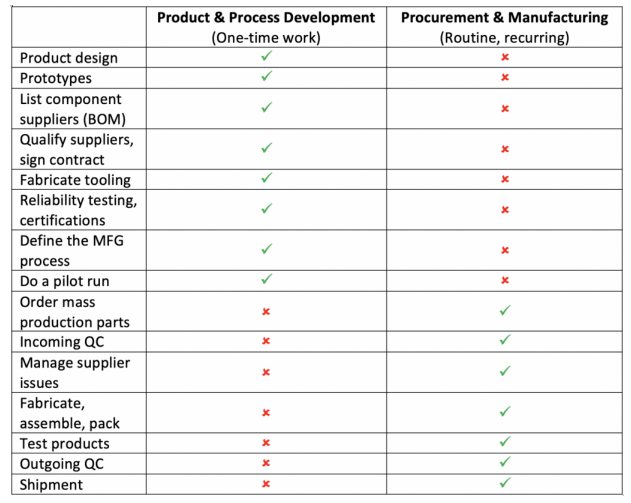

Every new product goes through 2 phases: development, then production

First, let’s look at what activities fall in what phase.

What do these differences mean?

a) When the product design and the manufacturing process are being developed and confirmed, it is partially a discovery phase. Especially if the product is entirely new and particularly unique.

(If the product is basically similar to another product, with an extra feature or a different outer design, it is usually considered low-risk and there is much less discovery involved.)

If the buyer finances that work, for example by hiring engineers or a design house, they know the tradeoffs involved and can make the right decisions.

If a manufacturer is in charge and makes decisions, what is their incentive? To get into production as fast as possible (because that’s when they start getting money) and to keep the product as simple as possible (to minimize headaches). That might be what the buyer wants, or that might not be.

b) Once the product is mature and is ready for mass production, the whole dynamic changes.

The basic model is as follows:

Product unit price = material cost + handling cost + manufacturing cost + export processing cost

If the supplier financed a part of development, they will add X USD into the price of each piece. Sometimes it is relatively transparent, and the buyer knows that extra charge will end after Y units have been made. In many cases, though, there is zero transparency. (And that’s often what allows for price increases that are out of control.)

And why would the buyer be given visibility on the cost structure? After all, the supplier has no idea about future order quantities (there is usually no firm commitment from the buyer, with penalties in case of lower-than-expected sales for example).

Typical Chinese OEM suppliers make the distinction between these 2 phases murky

They usually say “we’ll take care of this engineering work” or “we’ll absorb half the cost of tooling”, and they raise the unit price. The typical buyer ensures the total cost is workable for selling the product on the market and goes ahead with the supplier’s offer.

Crime investigators often wonder, ‘to whom is it a benefit?‘. And, as an advisor, I often my clients, ‘what are the incentives of the supplier?’.

Well, their incentive is to get development work done in a “quick and dirty” way, and that creates all sorts of issues in production. Based on my observations over the past 15 years, they don’t worry much about those risks for a variety of reasons (they will ship defective pieces to their customer, they are over-enthusiastic, and so forth).

That’s not what happens 100% of the time, and of course, some Chinese manufacturers do a good job, but we have seen this many times and there is definitely a pattern to watch out for…

And what happens if you have had enough of your supplier’s poor quality and timing record, not to mention their ever-increasing prices? You can’t pull the tooling and you can’t have the design files in native format. After all, you didn’t pay it in the first place. It is not yours unless a legally enforceable contract says so…

Good development work leads to low-risk and lower-cost production

I often heard that, by the time a product gets to production, 80% of the costs have already been set. That’s why great product design & process engineering is so valuable.

Good development leads to the following benefits:

- Easy assembly process

- Qualified component suppliers who deliver quality on time

- Risk analysis (DFMEA, PFMEA…) and actions

- Pilot run(s) to detect issues and address them

- Tools, jigs, fixtures to make the work easier and better

- Operators training, good work instructions

All this is particularly valuable if you anticipate relatively large volumes. And, if you count on your OEM supplier to do this, you might find that they end up doing nothing to reduce production risks!

If you are in a hurry to get to market and if you are comfortable with a high risk level (for example, your company is not in danger if the entire first batch of production has to be scrapped), it may be OK to skip most/all of these steps and keep development as simple as possible. Typical OEM suppliers might be a great fit for you.

*********

What about you? Have you let your suppliers subsidize some of the development cost? How have you kept production-related risks acceptable?

The New Product Introduction Process Guide for Hardware Startups

In this guide, we explore everything that inventors, SMEs, and hardware startups need to know about making a new product in China and bringing it to market.

We include:

- Why preparation between product design and launch is necessary

- Exploring the NPI process, from product idea to production

- Finding the right manufacturing partner

- Design reviews & adjustments: DFM, DTC, DFQ

- Optimizations for improving cost and quality

- Small production runs before mass production

- Your role in the NPI process

If you’d find this helpful, take a look now over at Sofeast by hitting the button below: