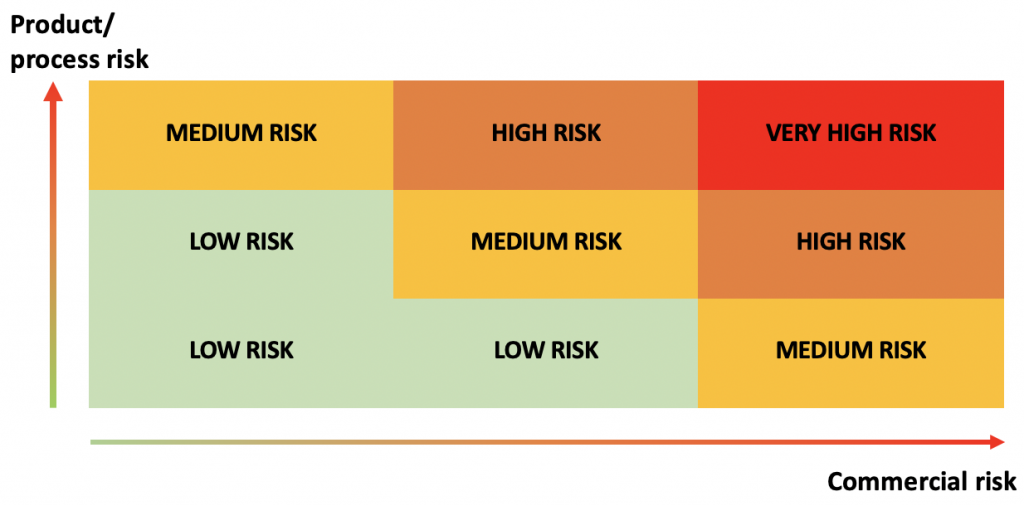

Every purchaser knows that some orders are riskier than others and the risk impacts many of the decisions they make. This is why quality planning and classifying orders by risk level is important for importers.

A common problem I have observed is a tendency to follow a ‘gut feeling’ rather than a structured analysis.

How to assess the risk properly, without spending a lot of time crunching numbers?

The 2 order risk criteria

You can grade each order on 2 sets of risk criteria, to keep things simple and manageable:

Risk component 1: The commercial risk

There is a higher potential loss on a 100,000 USD order than on a 10,000 USD order. That’s obvious, and it needs to be taken into account.

Similarly, your company’s management probably feels worse about delaying or even cancelling certain orders due to the customers they are destined to. Maybe one customer charges particularly steep penalties. Maybe ten customers are waiting for a certain product, and it is always harder to disappoint and calm down ten companies than just one.

Risk component 2: The process and/or product risk

Certain types of products are more prone to quality issues than others. Here are a few examples:

- Powder coating aluminium in light grey color often results in more rejects than in black color.

- A wire bra in non-stretch material is much more likely to have sizing problems than a molded bra.

- A coffee machine is more complex than a toaster, and it comes with many more potential issues.

Another important factory is ‘new in at least one way’ vs. ‘already running identically’. Highly customized product is inherently more risky than a product that has been made 1 million times, the same way and in the same facility.

And, along the same idea, some manufacturers have proven more reliable than others. You can probably get data easily on this topic (e.g. % of passed inspections over the past 2 years).

Looking at the big picture

Last week, I talked with someone working for a large retailer and mentioned they classified their orders this way:

That’s a smart way of visualizing the situation. I like it.

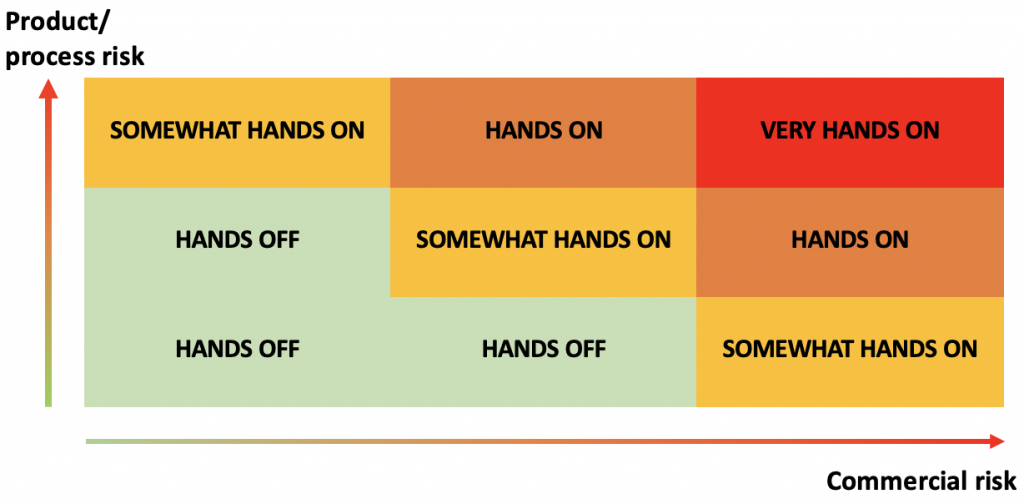

Now, what to do with orders that fall into the red or orange areas? They should get special treatment. The buyer’s team should be more ‘hands on‘.

In practical terms, what can you do?

I don’t know your exact situation, but here are two extreme examples.

Example 1: Quality planning for orders in the red area

- Qualify the factory before giving them the order – audit them, ensure they do the basics of process control and they have a solid quality system.

- Be extra clear on your quality standard, if possible with a detailed checklist and a perfect sample, but also with boundary samples. Train their people on your standard.

- Have a backup factory ready to hit the ground running should things not go well.

- If the process is somewhat different (custom), don’t skip the pilot run. Another approach is to cut the order into two small orders (to be processed at different times, rather than in one large batch).

- Be on top of the list of issues that came up, and drive improvement on the most serious issues.

- Have someone on site for checking the components, then for the first article inspection, and also during production.

Example 2: Quality planning for orders in the green area

- Qualify the factory, ensure they have the basics of a quality system.

- Give them a clear quality standard

- Do a final random inspection, or (if the supplier has a good track record), ask them to do self inspections.

*****

How do you evaluate the way different orders should be managed? Have you got any tips that you can share? Please leave them as a comment or any questions you may have, too.

8 Elements of a Low-Risk Supply Chain in China

This FREE webinar will empower you to transform your supply chain in China to reduce risks. Two industry experts, Renaud Anjoran and Paul Adams from Sofeast, talk you through how to gain control over your product’s quality, on-time shipments, long-term pricing stability, and continuity of supply.

Ready to watch? Register by hitting the button below: